Vea también

On Tuesday, the EUR/USD currency pair continued its upward trend without any corrections or pullbacks. For a few days, the euro traded between the levels of 1.0804 and 1.0888 before resuming its ascent. There were no significant macroeconomic factors influencing this movement, similar to previous trends. The only notable report released that day was the JOLTs job openings data from the U.S., which was slightly better than expected. However, this did not affect the dollar's performance, as Donald Trump announced new tariffs on Canada overnight. Specifically, he expanded existing tariffs in response to Canada's refusal to easily accept becoming the 51st state of the U.S. Import tariffs on steel and aluminum were doubled, and the market clearly reacted to Trump's decisions.

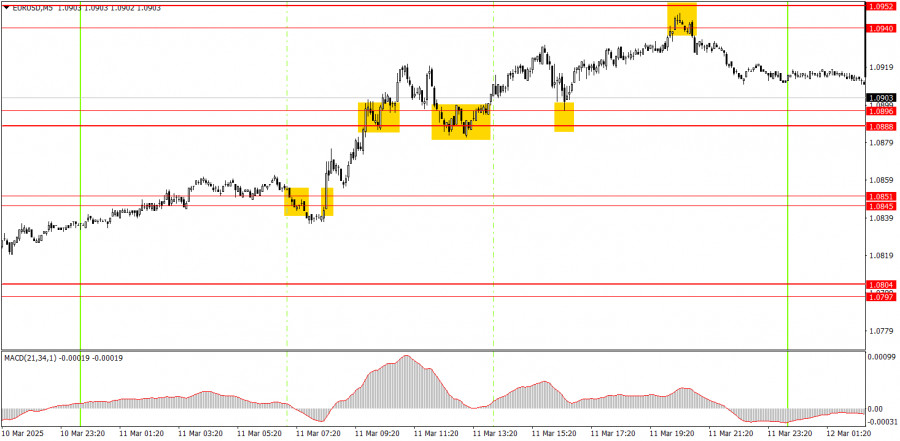

On the five-minute timeframe on Tuesday, several trade signals were generated. The first sell signal around the 1.0845-1.0851 area turned out to be false. However, the subsequent buy signal from the same range allowed traders to secure a good profit. Three more buy signals followed, enabling novice traders to maintain long positions easily. Eventually, the pair reached the 1.0940-1.0952 zone and bounced off it, which provided an optimal point for closing long positions and even opening short positions.

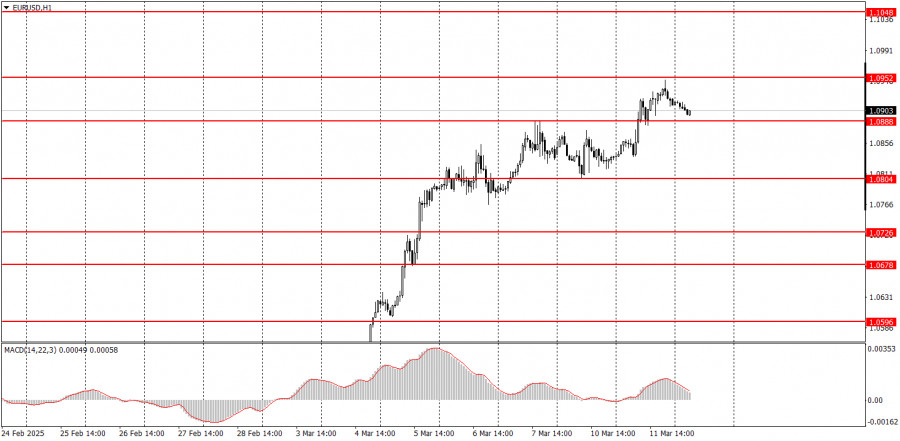

In the hourly timeframe, EUR/USD remains on a medium-term downward trend, though the chances of its continuation are decreasing. The fundamental and macroeconomic background continues to favor the U.S. dollar much more than the euro, so we still expect a decline. However, Donald Trump continues to drag the dollar down with his daily decisions and statements. Currently, fundamentals and macroeconomics are overshadowed by politics and geopolitics.

On Wednesday, the euro could move in any direction, as macroeconomic and fundamental factors no longer consistently impact the pair. The U.S. inflation report is important, but Trump's actions are more significant.

For the five-minute timeframe, consider trading around the levels of 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0952, 1.1011, 1.1048. The U.S. inflation report for February is set for release, and we would have called it a major event just a week and a half ago. Now, it barely matters, as the market is solely reacting to Trump's decisions and statements.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.