Vea también

10.03.2025 12:51 PM

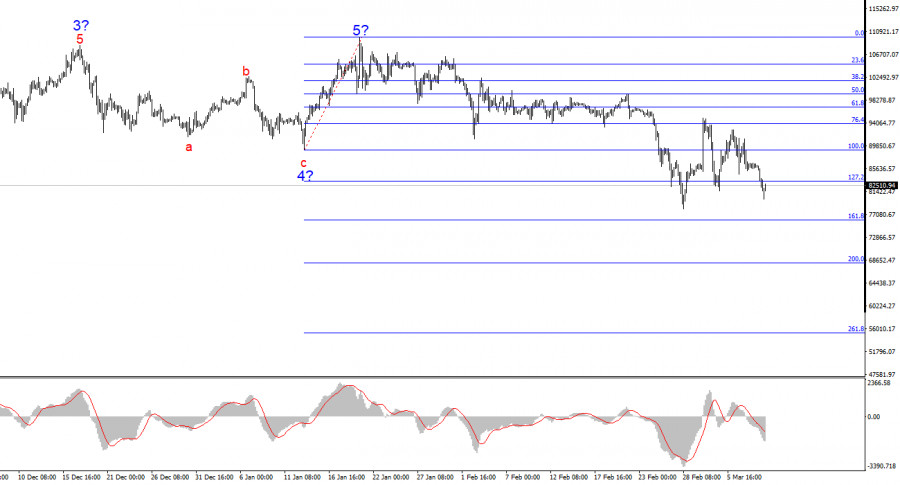

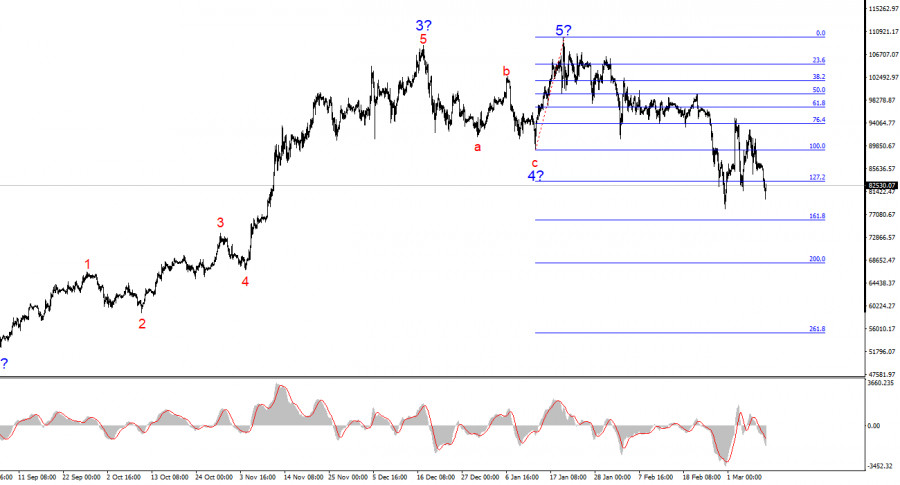

10.03.2025 12:51 PMThe 4-hour wave structure for BTC/USD is quite clear. After the completion of a five-wave bullish trend, the market has transitioned into a bearish corrective phase. Given this, I do not expect Bitcoin to rise above $110,000–$115,000 in the coming months.

The news cycle has fueled Bitcoin's growth in recent months, with continuous reports of institutional investments, government adoption, and pension fund allocations into the crypto market. However, Trump's policies have driven investors away, and no trend can remain bullish indefinitely.

The wave that began on January 20 does not resemble an impulsive wave. Instead, we are dealing with a complex corrective structure, which could last for months. The internal wave structure of this first corrective phase is highly complex and ambiguous. As a rule, wave structures should be as simple and clear as possible for effective trading.

Over the past few days, BTC/USD has dropped by $10,000. Even Trump's speech, which focused entirely on cryptocurrencies, Bitcoin reserves in the U.S., and the future of the crypto industry, failed to provide support.

Since Trump officially took office, the U.S. stock market, Bitcoin, and the U.S. dollar have all been falling. Typically, a decline in the dollar should lead to an increase in the value of dollar-denominated assets, including Bitcoin. However, Trump has achieved something unusual: both the dollar and Bitcoin are falling simultaneously, along with U.S. stock indices.

At this point, market participants are avoiding risk assets, as the future remains highly uncertain. While uncertainty is always present in financial markets, there are varying degrees of it. Trump is reshaping global policies, and no one knows the long-term consequences for the U.S. itself. Given this backdrop, investors are likely seeking safe-haven assets to navigate these volatile conditions.

Based on my BTC/USD analysis, I conclude that Bitcoin's uptrend is over for now. Everything currently points toward a complex, multi-month correction. I have previously advised against buying Bitcoin, and this recommendation remains unchanged.

A break below wave 4's low would confirm the transition into a downtrend, most likely of a corrective nature. For now, I see the best opportunities on the short side by analyzing lower timeframes. Bitcoin could fall to $76,000 (161.8% Fibonacci extension) and $68,000 (200.0% Fibonacci extension) in the coming weeks. Before expecting a new uptrend, I would like to see at least three clear and well-defined bearish waves.

On higher timeframes, a five-wave bullish structure is evident. At present, the market is forming either a corrective pullback or an extended bearish wave cycle.

Core Principles of My Analysis:

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El Ethereum apenas logró recuperarse hasta el FVG más cercano y durante dos semanas no pudo seguir subiendo. Sin embargo, el Bitcoin finalmente arrastró hacia arriba a su "hermano menor"

El Bitcoin continuó su movimiento ascendente el martes, lo que generó muchas preguntas. Sin embargo, recordemos que el análisis técnico no puede proporcionar señales con una precisión del 100% todo

El Bitcoin se activó durante el pasado fin de semana, sin que hubiera razones ni fundamentos concretos para ello. Simplemente el mercado volvió a lanzarse a comprar la primera criptomoneda

El Bitcoin y el Ethereum permanecen dentro de sus canales laterales y la incapacidad para salir de estos rangos podría poner en peligro las perspectivas de una recuperación más amplia

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.