Vea también

21.10.2024 06:32 AM

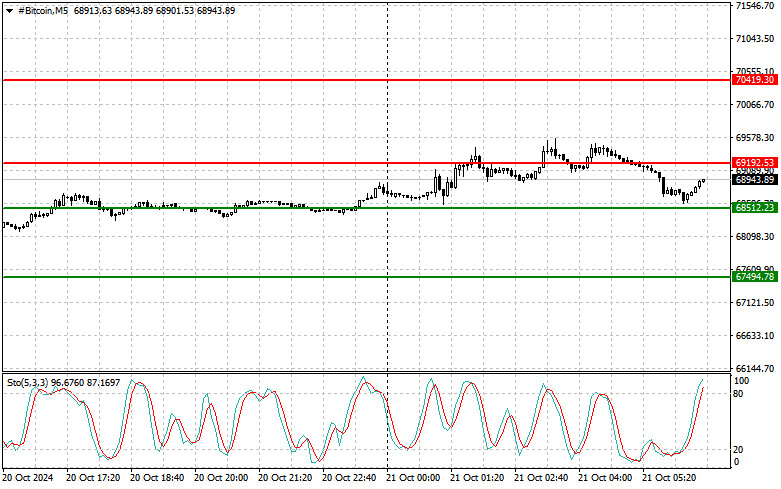

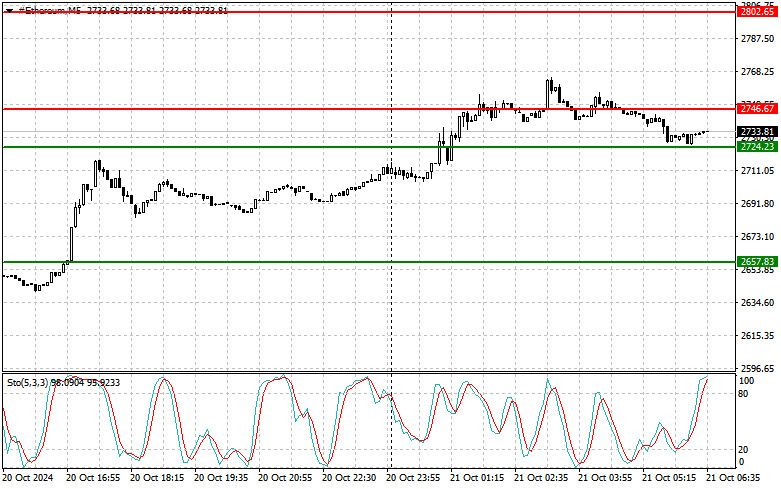

21.10.2024 06:32 AMNo one wants to sell Bitcoin and Ethereum even at current highs—for now. These trading instruments' lack of active upward movement will likely lead to a major sell-off or a decent correction. Without such a correction, the chances of Bitcoin reaching a new all-time high are pretty slim.

Among the positive technical signals, the most notable is the MACD histogram moving into positive territory for the first time since April of this year. This can be seen on the weekly chart, indicating a resumption of the upward trend and suggesting a bullish resolution to the prolonged period of Bitcoin trading between $50,000 and $70,000.

This positive technical outlook aligns with the consensus that the Federal Reserve's renewed inclination to lower rates and the increasing likelihood of Republican Party candidate Donald Trump winning the U.S. elections on November 5 could positively impact the entire cryptocurrency market. As a result, Bitcoin might reach around $100,000 by the end of December. There are currently more positive signals than negative ones, such as geopolitical tensions, so it is best to follow the trend.

For intraday trading in the cryptocurrency market, I will focus on any significant dips in Bitcoin and Ethereum, aiming to capitalize on continuing the medium-term bullish trend, which has not gone anywhere.

The strategy and conditions for short-term trading are detailed below.

Buy Scenario

Today, I plan to buy Bitcoin upon reaching the entry point around $69,192, targeting a rise to $70,419. Around $70,419, I will exit from buying and sell immediately on the rebound. Before buying on a breakout, it's best to ensure that the Stochastic indicator is near its lower boundary, around the 20 level.

Sell Scenario

Today, I plan to sell Bitcoin upon reaching the entry point of around $68,512, targeting a drop to $67,500. Around $67,500, I will exit selling and buy immediately on the rebound. Before selling on a breakout, ensure the Stochastic indicator is near its upper boundary, around the 80 level.

Buy Scenario

Today, I plan to buy Ethereum upon reaching the entry point around $2,746, targeting a rise to $2,802. Around $2,802, I will exit from buying and sell immediately on the rebound. Before buying on a breakout, ensure the Stochastic indicator is near its lower boundary, around the 20 level.

Sell Scenario

Today, I plan to sell Ethereum upon reaching the entry point around $2,724, targeting a drop to $2,657. Around $2,657, I will exit selling and buy immediately on the rebound. Before selling on a breakout, ensure the Stochastic indicator is near its upper boundary, around the 80 level.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El Ethereum apenas logró recuperarse hasta el FVG más cercano y durante dos semanas no pudo seguir subiendo. Sin embargo, el Bitcoin finalmente arrastró hacia arriba a su "hermano menor"

El Bitcoin continuó su movimiento ascendente el martes, lo que generó muchas preguntas. Sin embargo, recordemos que el análisis técnico no puede proporcionar señales con una precisión del 100% todo

El Bitcoin se activó durante el pasado fin de semana, sin que hubiera razones ni fundamentos concretos para ello. Simplemente el mercado volvió a lanzarse a comprar la primera criptomoneda

El Bitcoin y el Ethereum permanecen dentro de sus canales laterales y la incapacidad para salir de estos rangos podría poner en peligro las perspectivas de una recuperación más amplia

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.