Vea también

13.06.2022 10:08 AM

13.06.2022 10:08 AMHello, dear traders!

Last week, GBP/USD was bearish. In a while, we will analyze the pair's technical picture in the weekly time frame. So far, let's discuss the record global inflation rate.

The Bank of England has already revised upward its inflation outlook for next year. In February, the central bank expected inflation to rise to 4.3%. The indicator is now seen spiking to 4.6%. At the same time, the long-term outlook has been upwardly revised to 3.5% versus 3.3%. In this light, the British economy is now under greater pressure, which means the Bank of England will have to tighten monetary policy further. About 70% of surveyed economists see the benchmark rate in the UK rising in the next 12 months. However, it is unclear how many rate hikes would be there. As a reminder, when the economy is in a good state, it can easily survive a rate hike cycle. Otherwise, it may enter a recession. This is where we'd like to mention the difference in the state of the British and American economies. The Fed has more room to maneuver. Meanwhile, the BoE has to analyze and monitor macro data no-stop not to harm the national economy.

As for GBP/USD, this trading week will have a crucial meaning. Most analysts consider the pound a hopeless outsider, especially versus the dollar. Nevertheless, we are not so sure about it. After all, it is important to remember that the sterling can move explosively and often unpredictably. T Fed will announce its interest rate decision on Wednesday. It will be followed by Chairman Powell's press conference. The Bank of England's turn will come the following day. The central banks are expected to raise the interest rate by 50 basis points and 25 basis points respectively. If actual results meet expectations, the rhetoric of their chiefs will be of utmost importance. Should Governor Bailey be hawkish, the pound will soar. Otherwise, it risks plunging further against the dollar.

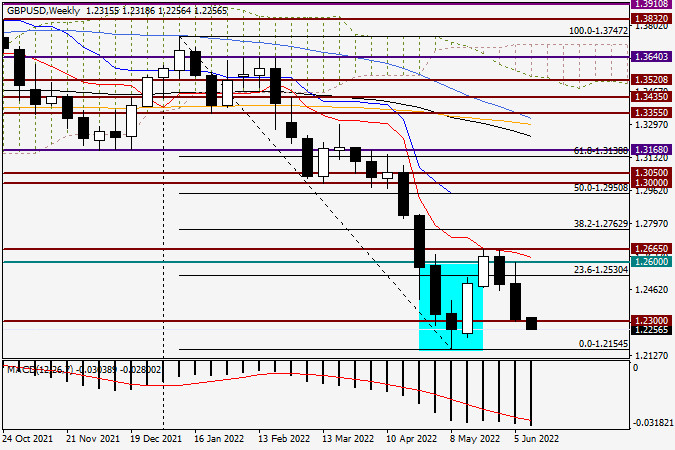

Weekly

On the weekly chart, the Moning start bearish reversal pattern consisting of three highlighted candlesticks is getting weaker. The price attempted to test it but gave it up after touching the red Tenkan Line of the Ichimoku indicator. Nevertheless, this pattern will cease after a true breakout at 1.2154 support only. Apart from the Tenkan Line, other important technical levels stand at 1.2600 and 1.2665 resistance. The latest candlestick is more bearish as it has a relatively long upper shadow as well as the body. Looking at last week's highs and lows, we can say the pair was rather volatile.

This week, resistance is seen at the 1.2600 high, and support stands at the 1.2300 low. In case of a breakout at 1.2300 and the close of weekly trading below it, the price may head towards 1.2154 support and test the level. If so, strong technical levels are seen at 1.2250 and 1.2200. The market may turn bullish after a succession of true breakouts at 1.2600 and 1.2665 as well as the red Tenkan Line of the Ichimoku indicator. This week, GBP/USD is going to trade under the influence of the Fed's and BoE's decisions. So, short positions could be opened after corrective moves to the 1.2400-1.2430 zone. We will talk about the actual entry points on GBP/USD in detail tomorrow when analyzing lower time frames.

Have a nice trading day!

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.