#MA (MasterCard Incorporated). Exchange rate and online charts.

Currency converter

28 Mar 2025 21:59

(-0.09%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

MasterСard Incorporated is an international payment system and transnational financial corporation which comprises 22 thousand financial institutions in 210 countries. It was established in 1966. In early 1990s, MasterCard purchased Access Сard. Fifteen years ago, MasterCard International merged with Europay International SA, the giant association which had been issuing Eurocard bank cards for a long time. In 2010 about 20% of the total number of payment cards were issued by MasterCard, while VISA, the former leader on the market, had 28.6% and China UnionPay was the first in the list with the share of 29.2%. Five years ago, MasterCard announced plans to expand its self-developed mobile app for contactless payments in the Middle East. In 2015 MasterCard had a 20% share of the market as well.

MasterCard International Incorporated and participants of this payment system are fully engaged in developing and applying technologies which are connected with chip cards. The corporation promotes this tool for safe payments on the electronic commerce market. Transactions in the MasterCard system are processed via the Banknet telecom network. This network enables all issuers of MasterCard bank cards to connect with processing centers and combine them in one financial unit. The MasterCard system differs from the VISA network as it operates the peer-to-peer system which sends transactions directly to the final network elements. Thus, MasterCard is more stable than other systems as a single technical failure is unlikely to disable the whole number of final network elements.

Shares in MasterСard Incorporated are in great demand on the stock market. In May 2017, the company revealed a strong report so its shares surged by more than 12%. The company’s revenue increased by 11.4% to 2.73 billion dollars, exceeding the forecast by The Wall Street Journal. Earnings per share advanced by 16.2% to $1.

During the first three months of 2017, MasterСard bought its own shares worth more than $1 billion and paid dividends amounting to $238 million. The company’s management confirmed the forecast of a rise in the net revenue for the current year. Some experts estimate that shares in MasterCard will advance further. In June 2017, MasterCard registered a cash inflow and the number of its customers increased. The rise was triggered after the corporation purchased VocaLink and NuData. A purchase of VocaLink helped MasterCard strengthen its position in the segment of immediate payments in the United Kingdom, Thailand, and Singapore. A purchase of NuData enabled the corporation to enhance security of transactions and customer confidentiality. In June this year the shares in MasterСard added 1.10%. Analysts anticipate that the #MA quotes will extend gains.

See Also

- Technical analysis / Video analytics

Forex forecast 31/03/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and Bitcoin.Author: Sebastian Seliga

10:50 2025-03-31 UTC+2

733

Fundamental analysisEUR/USD. Hello, April: Eurozone Inflation Report, ISM Indices, and Nonfarm Payrolls

The first week of every month is the most informative for EUR/USD traders. April is no exception, meaning the upcoming week promises to be interesting and volatile.Author: Irina Manzenko

06:28 2025-03-31 UTC+2

718

Fundamental analysisGBP/USD Pair Overview – March 31: Nonfarm Payrolls, Trump, and Unemployment May Create New Problems for the Dollar

The GBP/USD currency pair continued to trade sideways near its highs on FridayAuthor: Paolo Greco

06:24 2025-03-31 UTC+2

703

- West Texas Intermediate (WTI) crude oil prices are attempting to attract buyers, but the market remains in a state of uncertainty.

Author: Irina Yanina

12:39 2025-03-31 UTC+2

673

Bulls decided to retreat slightly, but Trump put a stop to itAuthor: Samir Klishi

11:58 2025-03-31 UTC+2

658

Trading Recommendations for the Cryptocurrency Market on March 31Author: Miroslaw Bawulski

11:02 2025-03-31 UTC+2

643

- Nikkei Falls 4%, Nasdaq Futures Fall 1.4% Trump Says U.S. Tariffs Will Apply to Every Country Gold Has Best Quarter Since 1986 Dollar Heading for Worst First Quarter Since Global Financial Crisis

Author: Thomas Frank

09:35 2025-03-31 UTC+2

643

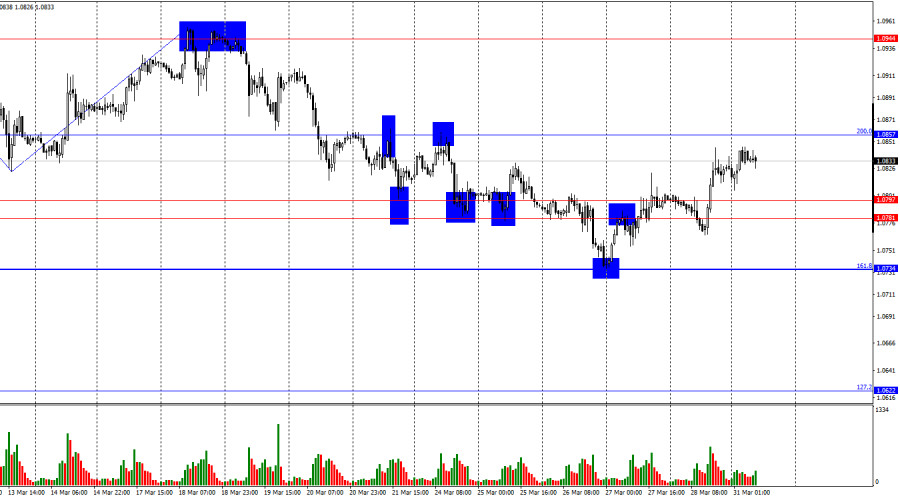

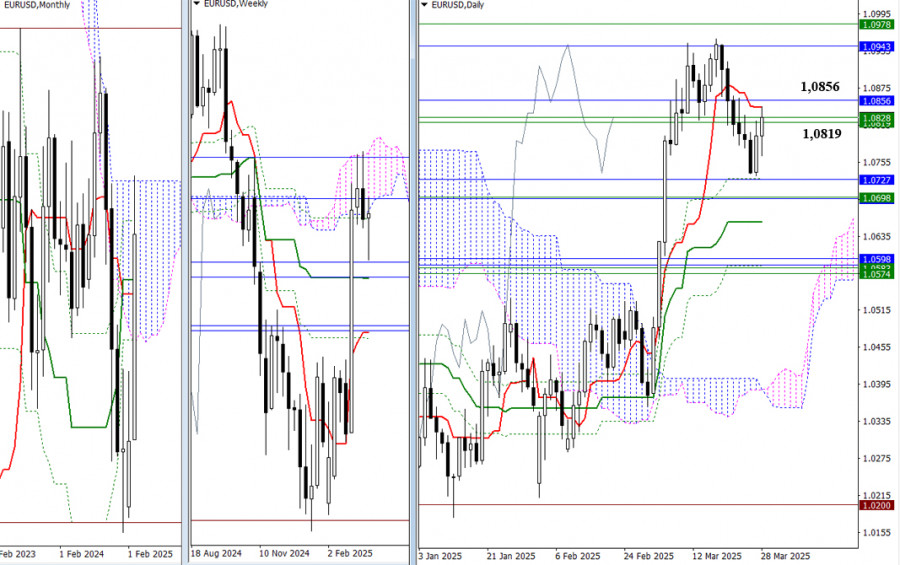

During the week, bearish players attempted to confirm the earlier-formed pullback and continue the decline but were unsuccessful, resulting in a long lower shadow on the weekly candlestick. The pair has returned to the cluster of resistance levels (1.0819–1.0856), which now represents the nearest r.Author: Evangelos Poulakis

09:07 2025-03-31 UTC+2

643

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, and #Ripple – March 31

In the coming days, a completion of the downward movement in the euro exchange rate is likely, potentially reaching the lower boundary of the calculated support zone. A reversal and renewed upward momentum are expected in the second half of the week.Author: Isabel Clark

11:12 2025-03-31 UTC+2

628

- Technical analysis / Video analytics

Forex forecast 31/03/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and Bitcoin.Author: Sebastian Seliga

10:50 2025-03-31 UTC+2

733

- Fundamental analysis

EUR/USD. Hello, April: Eurozone Inflation Report, ISM Indices, and Nonfarm Payrolls

The first week of every month is the most informative for EUR/USD traders. April is no exception, meaning the upcoming week promises to be interesting and volatile.Author: Irina Manzenko

06:28 2025-03-31 UTC+2

718

- Fundamental analysis

GBP/USD Pair Overview – March 31: Nonfarm Payrolls, Trump, and Unemployment May Create New Problems for the Dollar

The GBP/USD currency pair continued to trade sideways near its highs on FridayAuthor: Paolo Greco

06:24 2025-03-31 UTC+2

703

- West Texas Intermediate (WTI) crude oil prices are attempting to attract buyers, but the market remains in a state of uncertainty.

Author: Irina Yanina

12:39 2025-03-31 UTC+2

673

- Bulls decided to retreat slightly, but Trump put a stop to it

Author: Samir Klishi

11:58 2025-03-31 UTC+2

658

- Trading Recommendations for the Cryptocurrency Market on March 31

Author: Miroslaw Bawulski

11:02 2025-03-31 UTC+2

643

- Nikkei Falls 4%, Nasdaq Futures Fall 1.4% Trump Says U.S. Tariffs Will Apply to Every Country Gold Has Best Quarter Since 1986 Dollar Heading for Worst First Quarter Since Global Financial Crisis

Author: Thomas Frank

09:35 2025-03-31 UTC+2

643

- During the week, bearish players attempted to confirm the earlier-formed pullback and continue the decline but were unsuccessful, resulting in a long lower shadow on the weekly candlestick. The pair has returned to the cluster of resistance levels (1.0819–1.0856), which now represents the nearest r.

Author: Evangelos Poulakis

09:07 2025-03-31 UTC+2

643

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, #Bitcoin, and #Ripple – March 31

In the coming days, a completion of the downward movement in the euro exchange rate is likely, potentially reaching the lower boundary of the calculated support zone. A reversal and renewed upward momentum are expected in the second half of the week.Author: Isabel Clark

11:12 2025-03-31 UTC+2

628