USDMXN (US Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

28 Mar 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/MXN (United States Dollar vs Mexican Peso)

USD/MXN is actively traded on Forex. This currency pair is gaining more popularity among traders since the Mexican peso became freely convertible against the other currencies on the market in 2008.

To date, Mexico is one of the most developed countries in Latin America, taking the leading position among them in terms of per capita income. The Mexican economy is mainly represented by the private sector as in 1980s there was a mass privatization program aimed at fighting against the crisis. Thus, the majority of Mexican enterprises are owned by foreign companies.

Mexico is a member of NAFTA - the North American Free Trade Agreement. For this reason, the country has an active trade with its neighbors - the United States and Canad - which makes up the largest part of the country's income.

Mexico is the major exporter of oil in its region. Currently, most of the country's revenues are generates by oil sector. However, the main source of income for Mexico is the service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbons are strongly depleted. The Mexican government has to reduce the volumes of extracted oil and natural gas to avoid new problems in the economy. According to forecasts, the country will soon be forced to import oil from abroad to meet the needs of its economy. All these circumstances have a significant impact on the Mexican national currency which is largely dependent on world oil prices. In addition, the Mexican peso exchange rate hinges on international ranking of the country which is calculated by the leading rating agencies.

See Also

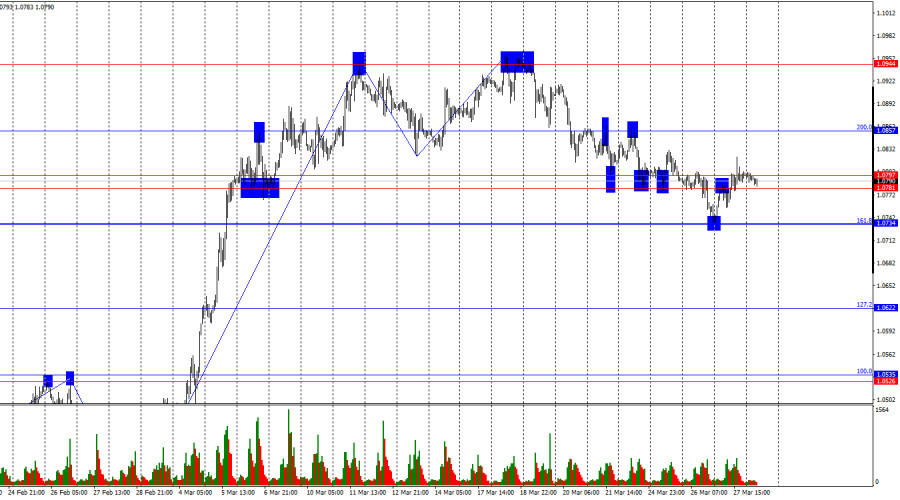

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1048

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

988

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

988

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

973

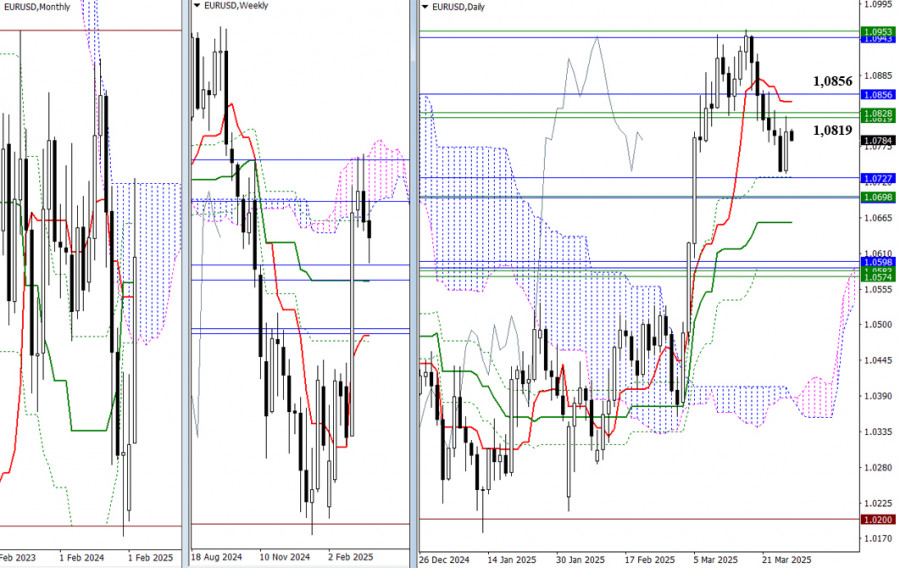

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

958

Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensifyAuthor: Irina Maksimova

12:24 2025-03-28 UTC+2

928

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

913

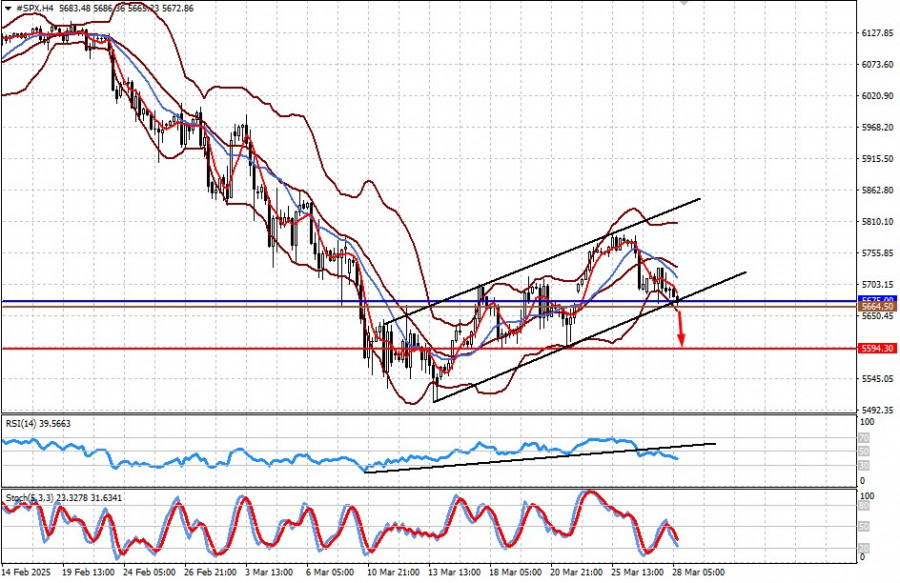

Stock Market on March 28th: S&P 500 and NASDAQ in a Difficult PositionAuthor: Jakub Novak

11:29 2025-03-28 UTC+2

913

Fundamental analysisMarkets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

898

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1048

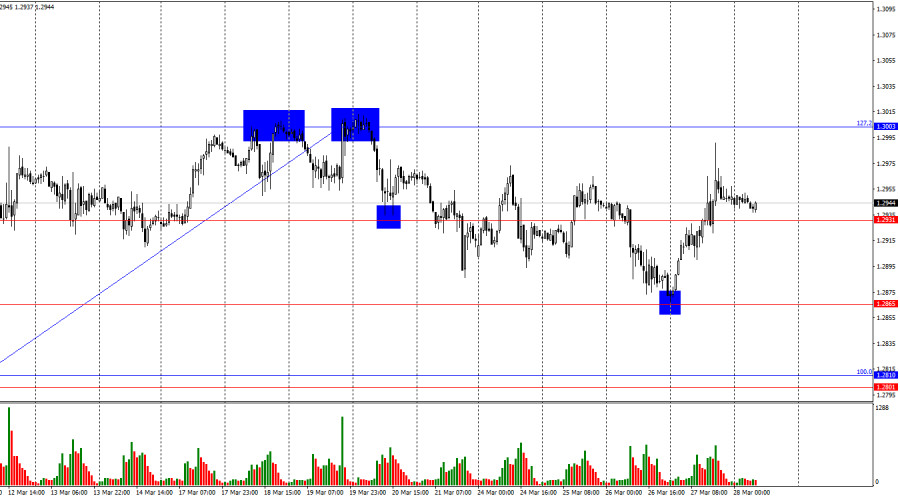

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

988

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

988

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

973

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

958

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

928

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

913

- Stock Market on March 28th: S&P 500 and NASDAQ in a Difficult Position

Author: Jakub Novak

11:29 2025-03-28 UTC+2

913

- Fundamental analysis

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

898