NZDHUF (New Zealand Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

27 Mar 2025 21:11

(-0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/HUF is not in great demand on Forex. The currency pair symbolizes the cross rate against the U.S. dollar. Although the U.S. currency cannot be found in this pair, it still has a significant influence on it. This can be seen, if you combine two charts: NZDUSD and USDHUF. By combining these two charts in the same price chart, you can get an approximate NZDHUF chart.

The U.S. dollar has a significant influence on both currencies. For this reason it is necessary to take into account the major U.S. economic indicators for the correct prediction of a future course of this financial instrument. These indicators include: the discount rate, GDP, unemployment, new created workplaces indicator and many others. Is necessary to note that discussed currencies could respond with different speed on changes in the U.S. economy, therefore, NZDHUF currency pair may be a specific indicator of change at these currencies.

When trading on the NZDHUF trading instrument, it is necessary take into account many features of the New Zealand economy, such as GDP, the discount rate, economic activity, the level of trade with other countries and many others. New Zealand is the largest producer of wool in the world, as well as its products. Therefore it is necessary to know the detail information about this indicator of New Zealand economy. It should be noted that New Zealand's economy is highly dependent on its main partners - the U.S., Australia and the Asia-Pacific. For this reason, you should also take into account a variety of economic indicators of main trading partners of New Zealand.

Hungary is a country with a high proportion of foreign capital in the economy. For this reason, the Hungarian economy is highly dependent on those organizations and countries that operate in the territory of this Central European state.

Hungary is an advanced industrial country in Central Europe. The main economic sectors in Hungary are engineering, metallurgy and chemical industry. Also Hungary has a very developed agriculture, a significant proportion of which are gardening and wine-making industries. Much of the products are exported abroad. A significant proportion of Hungarian income is international tourism. Millions of foreigners visit this country annually, because they attracted by the nature of the country and its ancient traditions and architecture. Hungary's main trading partners are EU countries and Russia. For this reason, when you assess the further course of the Hungarian forint, you should pay special attention to economic indicators of these regions.

This trading instrument is relatively illiquid if we’ll compare it with major currency pairs, such as: EURUSD, USDCHF, GBPUSD and USDJPY. Therefore, when you make a prognosis for the financial instrument, you should primarily focus on those currency pairs that include a U.S. dollar in tandem with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers are usually set a higher spread than the more popular currency pairs, so before you start working with the cross-rates, it should be carefully acquainted with the conditions offered by the broker to trade with specified trade instrument.

See Also

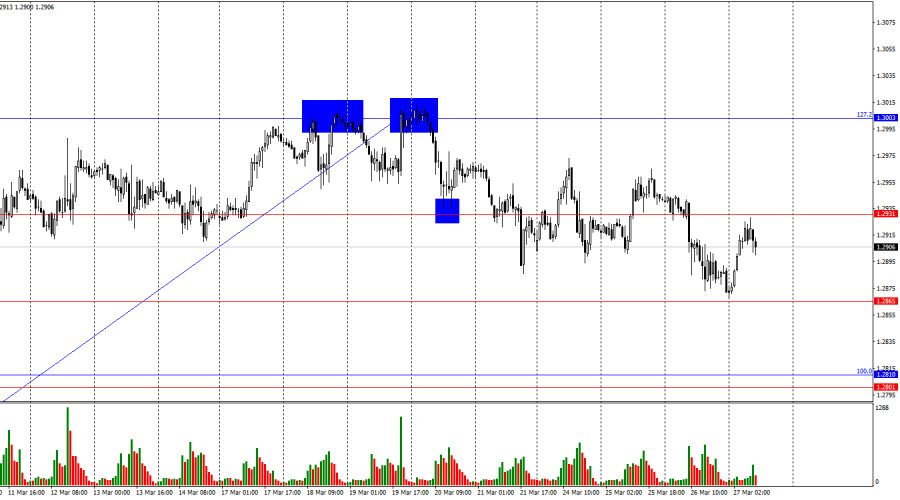

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1498

Fundamental analysisWho Had Any Doubts? Trump Remains Committed to His Economic Course (GBP/USD May Fall, #SPX May Rise)

Despite the ongoing political maneuvering, U.S. President Donald Trump remains committed to his economic strategy. This approach aims to dismantle the long-standing global economic model in which the U.S. primarily produces money while the rest of the world supplies the goodsAuthor: Pati Gani

10:21 2025-03-27 UTC+2

1153

President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.Author: Gleb Frank

12:15 2025-03-27 UTC+2

1153

- Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

Author: Irina Yanina

10:58 2025-03-27 UTC+2

1138

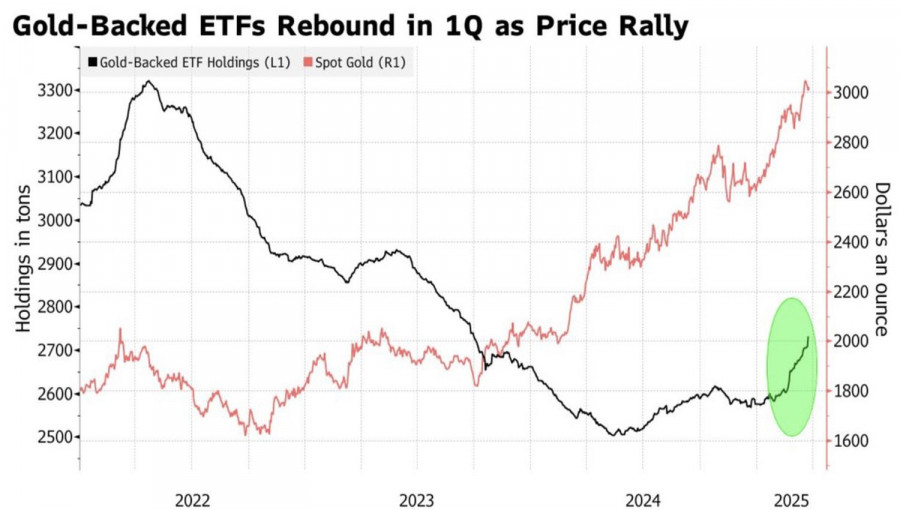

Trade tensions are driving demand for safe-haven assets.Author: Irina Yanina

11:44 2025-03-27 UTC+2

1123

US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and EuropeAuthor: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1093

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1018

The US crypto regulation bill is progressing rapidly through the legislative process.Author: Jakub Novak

11:52 2025-03-27 UTC+2

988

Once you understand how the system works, winning isn't hardAuthor: Marek Petkovich

11:55 2025-03-27 UTC+2

883

- Bears are starting to tip the scales in their favor

Author: Samir Klishi

11:19 2025-03-27 UTC+2

1498

- Fundamental analysis

Who Had Any Doubts? Trump Remains Committed to His Economic Course (GBP/USD May Fall, #SPX May Rise)

Despite the ongoing political maneuvering, U.S. President Donald Trump remains committed to his economic strategy. This approach aims to dismantle the long-standing global economic model in which the U.S. primarily produces money while the rest of the world supplies the goodsAuthor: Pati Gani

10:21 2025-03-27 UTC+2

1153

- President Donald Trump is reportedly preparing to announce new auto tariffs in the near future. Dollar Tree shares rose following the sale of its Family Dollar business. GameStop stock surged on its Bitcoin bet and stronger fourth-quarter earnings. The Nikkei dropped by 1%.

Author: Gleb Frank

12:15 2025-03-27 UTC+2

1153

- Today, the EUR/USD pair is gaining some positive traction, breaking a six-day losing streak.

Author: Irina Yanina

10:58 2025-03-27 UTC+2

1138

- Trade tensions are driving demand for safe-haven assets.

Author: Irina Yanina

11:44 2025-03-27 UTC+2

1123

- US President Donald Trump imposed 25% tariffs on auto imports, triggering a sharp sell-off in equity markets. The S&P 500 and Nasdaq indices fell as investors grew concerned about escalating trade tensions with Canada, Mexico, and Europe

Author: Ekaterina Kiseleva

12:02 2025-03-27 UTC+2

1093

- Technical analysis of EUR/USD, USD/JPY, USDX and Bitcoin

Author: Sebastian Seliga

12:24 2025-03-27 UTC+2

1018

- The US crypto regulation bill is progressing rapidly through the legislative process.

Author: Jakub Novak

11:52 2025-03-27 UTC+2

988

- Once you understand how the system works, winning isn't hard

Author: Marek Petkovich

11:55 2025-03-27 UTC+2

883