یہ بھی دیکھیں

27.11.2024 07:24 AM

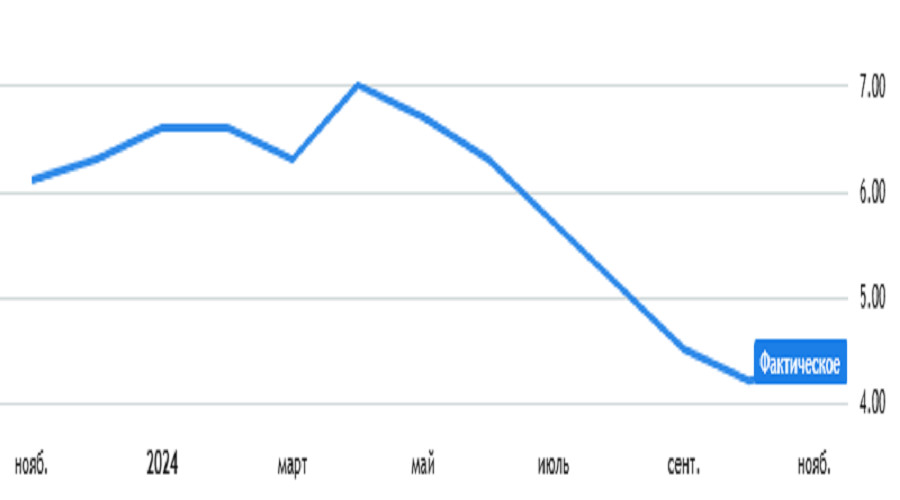

27.11.2024 07:24 AMAs expected, the Federal Open Market Committee meeting minutes didn't reveal anything new. Given the dollar's excessive overbought condition, a continuation of the corrective movement, that is, some strengthening of the euro, could have been anticipated. However, the dollar received unexpected support from U.S. housing prices, maintaining their growth rate. While a slowdown from 4.4% to 4.1% had been expected, the figures remained unchanged, keeping the market in a holding pattern.

Today, the macroeconomic calendar is filled with various data from the U.S., but attention should primarily focus on durable goods orders, which are expected to grow by 0.3%. The forecast looks highly optimistic, considering they declined by 0.7% the previous month. If confirmed, the dollar could strengthen slightly. However, the growth will likely be modest due to the dollar's overbought condition.

Meanwhile, the GDP data is unlikely to generate significant interest since it represents the second estimate, which is expected to confirm the already accounted-for first estimate. Similarly, data on jobless claims is unlikely to have much impact due to the minimal changes anticipated. The total number of claims is projected to decline by 16,000, which isn't enough to shift investor sentiment.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.