USDHUF (US Dollar vs Hungarian Forint). Exchange rate and online charts.

Currency converter

31 Mar 2025 01:05

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

USD/HUF (United States Dollar vs Hungarian Forint)

USD/HUF is not actively traded on Forex. The exchange rate of this instrument was pegged to the euro since its introduction in most countries of the European Union. However, in 2008 the country launched the floating forint rate.

Hungary is a country with high proportion of foreign capital, for this reason, its economy is highly dependent on those organizations that operate within the territory of this Central European state.

Hungary is an advanced industrial country of Central Europe. The Hungary's economy is represented mostly by engineering, metallurgy, and chemical industries. Moreover, agricultural sector, especially gardening and wine making sectors, is also robust. The greater part of the products are exported abroad. Tourism is pivotal to Hungarian economy. Millions of foreigners visit this country annually, attracted by its nature, ancient traditions, and architecture. Hungary's main trading partners are the EU countries and Russia. For this reason, when you try to predict the further course of the Hungarian forint, you should pay the utmost attention to the economic indicators of these regions.

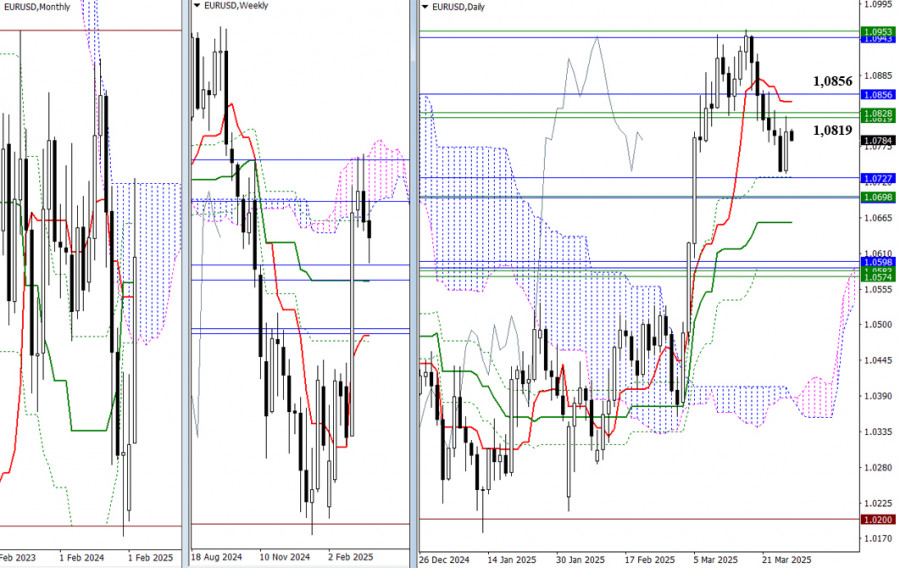

If you trade USD/HUF, you need to consider the dynamics of EUR/USD, GBP/USD, and USD/JPY currency pairs as they can influence the forint greatly indicating the future course of the Hungarian national currency. In addition, monitor the global prices for oil and other minerals vital for the country's economy as they can change the USD/HUF rate.

See Also

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2263

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

2143

Bulls have been attacking for two weeks, but they've run out of steamAuthor: Samir Klishi

11:48 2025-03-28 UTC+2

2128

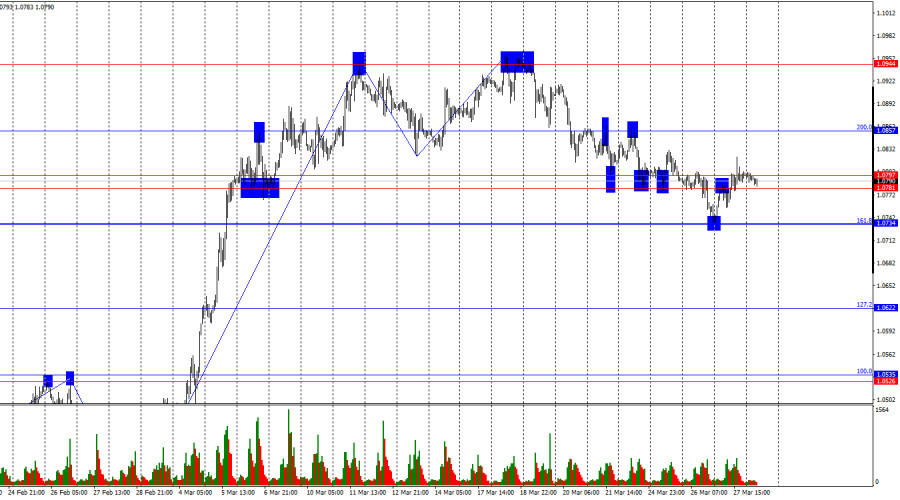

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

2008

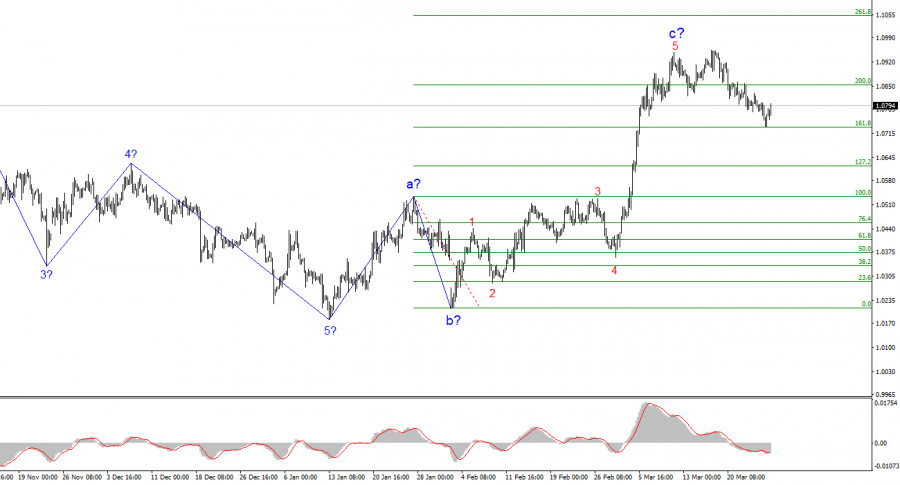

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

1843

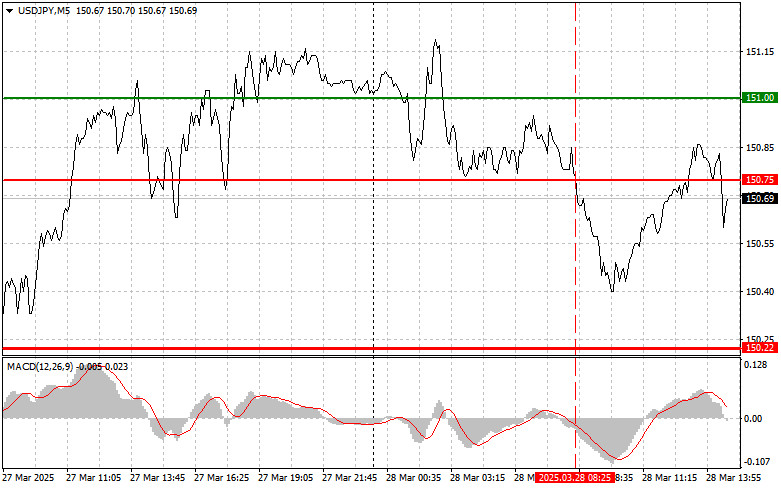

USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)Author: Jakub Novak

20:04 2025-03-28 UTC+2

1813

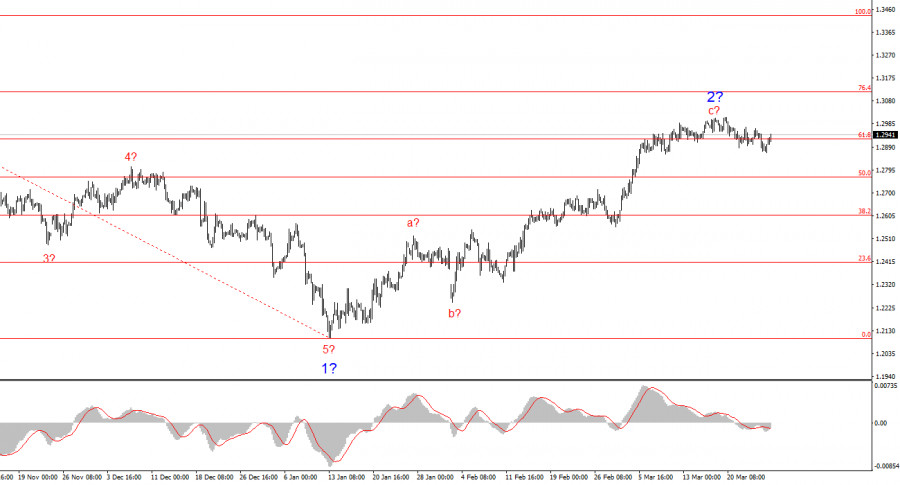

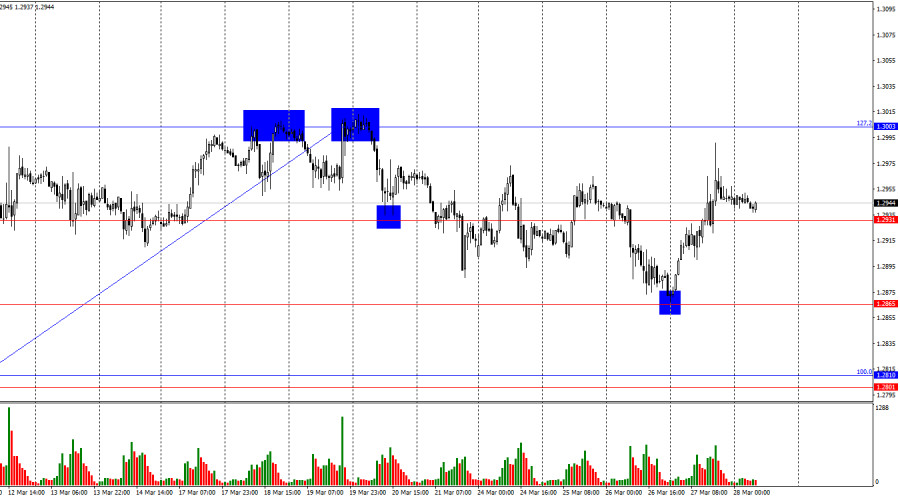

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1753

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1723

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

1693

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2263

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

2143

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

2128

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

2008

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1843

- USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)

Author: Jakub Novak

20:04 2025-03-28 UTC+2

1813

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1753

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1723

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

1693