यह भी देखें

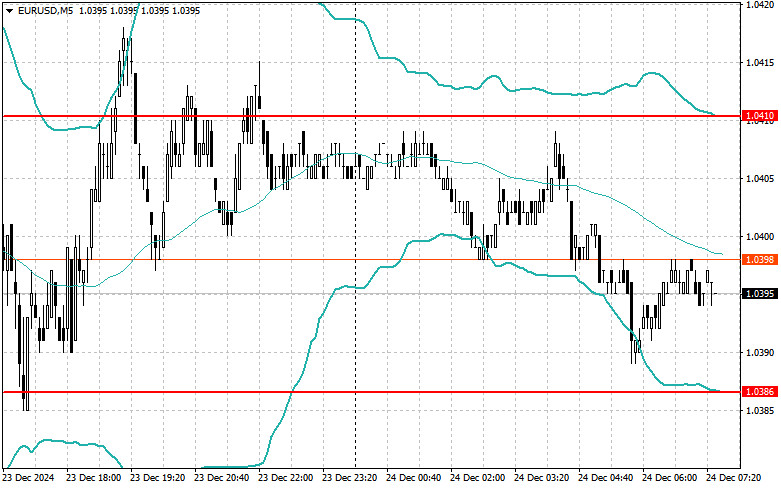

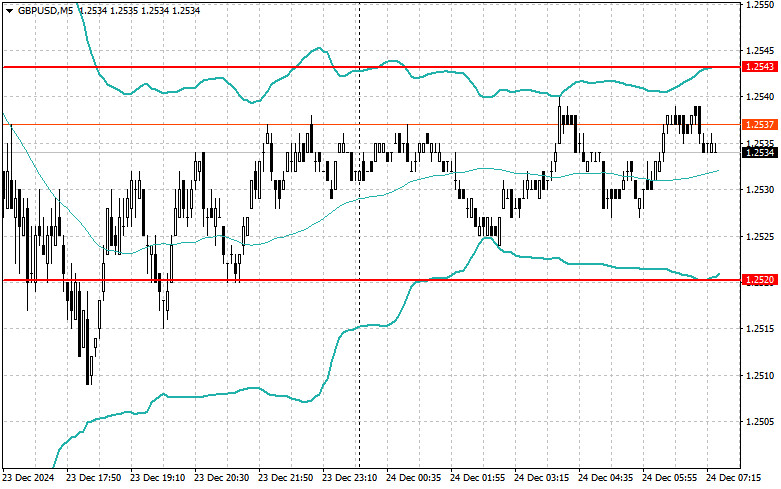

Buyers of the euro and the pound have stepped back. While the pound has encountered significant issues following the GDP data, the euro has only experienced a normal correction.

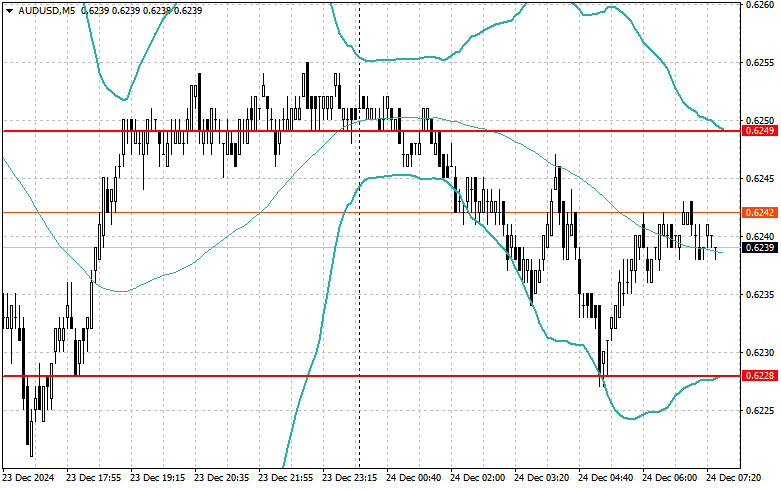

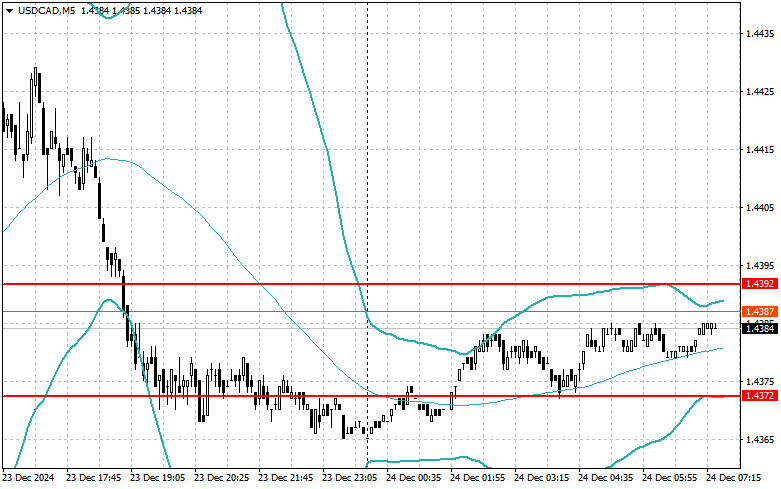

It is evident that as we approach the holiday season, market direction is being influenced more by psychological factors than by economic indicators. Traders are increasingly focused on news, rumors, and overall sentiment, contributing to less volatility in the markets. However, this psychological dynamic can lead to sharp price fluctuations, even when the underlying economic conditions remain stable.

Due to the lack of significant data from the UK and the eurozone during the first half of the day, traders are expected to act cautiously, which may lead to reduced market volatility. This anticipated sideways trading in the euro, pound, and other risk assets will give market participants an opportunity to adapt to current conditions. However, there may be activity from major players looking to take advantage of the uncertainty to adjust their positions. This could lead to temporary sharp movements at certain points during the trading session, but overall, the market is likely to remain within a horizontal channel.

If the data aligns with economists' expectations, it's advisable to use the Mean Reversion Strategy. However, if the data significantly exceeds or falls short of expectations, the Momentum Strategy is recommended.

Mean Reversion Strategy (Reversal):

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |