Lihat juga

27.01.2025 12:50 PM

27.01.2025 12:50 PMAnalysis:Since August last year, the major EUR/USD pair has been in a dominant downtrend. The price decline brought quotes to the upper boundary of a potential large-scale reversal zone. Since the beginning of the year, a corrective bullish wave in the form of an extended flat has been developing, which is not yet complete. A short-term pullback is likely needed within its structure.

Forecast:In the coming week, EUR/USD is expected to trade sideways within nearby counter-directional zones. Initial days may see upward pressure and a brief breach of the upper resistance boundary. A decline is likely in the latter half of the week, but not beyond the lower boundary of the price channel.Potential Reversal Zones:

Recommendations:

Analysis:The incomplete wave structure of USD/JPY aligns with the global uptrend that started in early August last year. Since December, the pair has been forming a sideways counter-correction. The wave level shows high potential, exceeding the size of the most recent bullish wave's pullback.

Forecast:The first half of the week is likely to see sideways movement within the price channel between opposing zones. A mild downward bias is possible in the initial days, with increased volatility and renewed price growth anticipated toward the weekend.

Potential Reversal Zones:

Recommendations:

Analysis:The current downward wave for GBP/JPY began in late December. Over the last two weeks, the mid-section (B) of this wave has been forming as an extended flat. The pair is approaching the upper boundary of a significant potential reversal zone.

Forecast:In the coming days, expect upward movement toward the calculated resistance level. Toward the end of the week, heightened volatility may lead to a price decline toward the support boundaries. A temporary breach of the upper resistance boundary cannot be ruled out during trend reversals.

Potential Reversal Zones:

Recommendations:

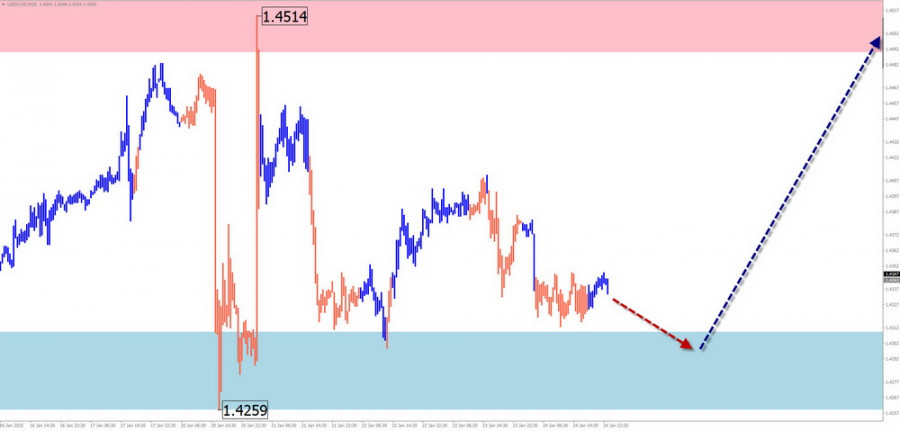

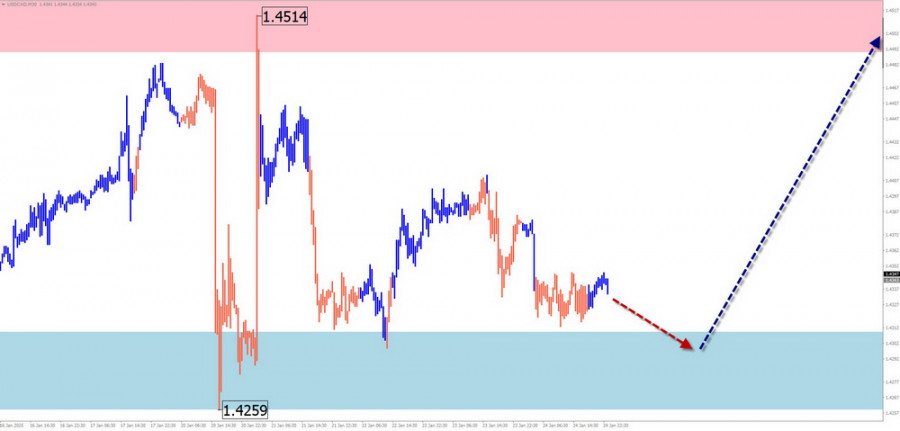

Analysis:Over recent years, the Canadian dollar's trend has been dictated by an upward wave. The ongoing wave since September 25 has been moving sideways for over a month. A corrective flat has been developing within the wave structure over the last two weeks. While the structure appears complete, no confirmed reversal signals are present.

Forecast:USD/CAD is expected to move along calculated support levels throughout the week. Toward the end of the week, price growth may resume, but gains are unlikely to exceed the resistance zone.

Potential Reversal Zones:

Recommendations:

Analysis:Since late September, the NZD/USD chart has been forming a downward impulse. In December, a counter-correction (B) began as an extended flat. This structure remains incomplete, and the pair is approaching the lower boundary of a large-scale potential reversal zone.

Forecast:Movements in the upcoming days are expected to mirror last week's trends. The upward movement may continue until the calculated resistance zone is reached. Toward the weekend, the likelihood of a reversal and downward movement toward support levels increases.

Potential Reversal Zones:

Recommendations:

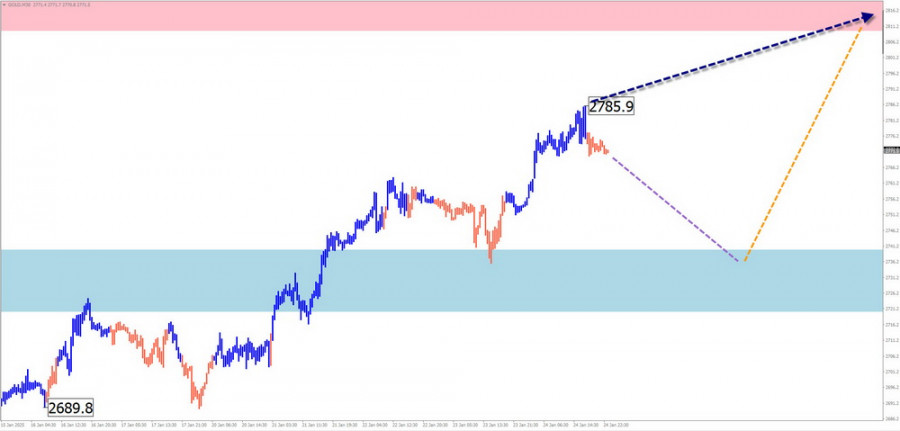

Analysis:After a corrective period in the fall, the gold chart is forming a new bullish zigzag wave. Currently, the final segment (C) is developing. Following last week's break above intermediate resistance, gold needs to consolidate at these levels.

Forecast:The first few days of the week may see a downward flat, lasting until midweek. Afterward, expect a surge in volatility, a trend reversal, and resumed active growth toward resistance levels. These events will likely coincide with key economic news releases.

Potential Reversal Zones:

Recommendations:

Explanation:In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). The analysis focuses on the latest incomplete wave across all timeframes. Dotted lines represent expected movements.

Note: The wave algorithm does not account for the time duration of price movements!

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

GBP/USD Analisis: Grafik harian pasangan mata uang Inggris menunjukkan struktur wave bullish yang sedang berlangsung sejak 13 Januari tahun ini. Bagian tengah wave (B) telah berkembang dalam beberapa minggu terakhir

EUR/USD Analisis: Pada pasangan utama euro, tren naik yang dimulai pada awal Februari terus berlanjut. Kuotasi tetap berada dalam zona potensi pembalikan yang luas. Selama tiga minggu terakhir, harga membentuk

Struktur gelombang untuk GBP/USD tetap agak ambigu, tetapi secara keseluruhan dapat dikelola. Saat ini, masih ada kemungkinan besar bahwa tren menurun jangka panjang akan berkembang. Gelombang 5 telah berbentuk meyakinkan

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.