Lihat juga

03.07.2023 06:37 PM

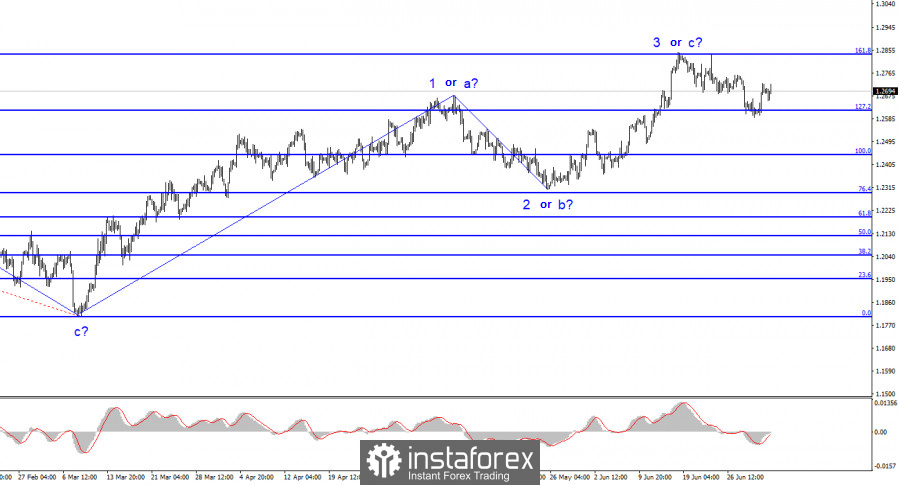

03.07.2023 06:37 PMThe wave pattern for the pound/dollar pair has become more straightforward. Instead of a complex corrective trend segment, we can see an impulsive upward or a simpler corrective one. At this time, the formation of a rising wave 3 or c continues, and the pound gets a great opportunity to grow up to the 30th figure. Whether this aligns with the current news background is for you to decide. The pound has no basis to continue rising to the 30th or 35th figure (which is quite possible if we talk about an impulsive trend segment), and the supposed wave 3 or c may already be completed. However, wave analysis can always transform into a more complex one. An unsuccessful attempt to break through the 127.2% Fibonacci mark indirectly indicates the market's readiness for new purchases.

A descending set of waves is expected for the euro, but the wave analysis can still transform into a similar one with the pound, and then everything will fall into place. A five-wave structure might exist inside wave 3 or c, suggesting at least one more wave up. However, the ongoing deviation of quotes from their highs for more than two weeks implies that the market is still being prepared for purchases.

The dollar would prefer to rise, but the current statistics don't support this

The pound/dollar exchange rate didn't change on Monday, showing similar movements to the euro/dollar pair. A weak business activity index in the UK manufacturing services sector was released in the first half of the day, followed by two similarly weak indices in the US after lunch. The British index fell from 47.1 points to 46.5, while the American ones dropped from 48.4 and 46.9 to 46.3 and 46.0, respectively. The greatest disappointment came from the ISM index, typically more stable and higher and considered more significant. The impacts of tighter monetary policies are universally felt across economies. We first wait to see which economy will start showing signs of negative economic growth.

A significant amount of economic data will be released this week. The markets will see more indices of business activity in service sectors, several reports on the US labor market's state, and reports on American unemployment and wages. It's worth highlighting the Nonfarm Payrolls and unemployment reports, which have held particular importance for the market and the dollar in recent months, even a year. If these prove negative, the likelihood of 2 FOMC rate hikes will diminish slightly, which may decrease demand for the dollar. The US currency would prefer to appreciate but needs more foundations.

Overall conclusions.

The wave pattern of the pound/dollar pair has changed and suggests the formation of a rising wave, which can end at any moment (or has already ended). Earlier, I advised buying the pair in case of an unsuccessful attempt to break through the 1.2615 mark, equivalent to 127.2% Fibonacci. Then wave 3 or c can take a more extended form, and the pair will return to the 1.2842 mark. Sales now look more promising, and I advised them two weeks ago with a Stop Loss set above the 1.2842 mark, but the signal from 1.2615 temporarily canceled this scenario. However, you can still stay in sales, moving the Stop Loss to zero.

The picture is similar to the euro/dollar pair on the larger wave scale, but there are still some differences. The descending corrective trend segment is completed, and the formation of a new, ascending one is ongoing, which may already be completed, or it may take a full-fledged five-wave form. And even if it takes a three-wave one, the third wave can be extended or shortened.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pola wave pada grafik GBP/USD juga telah berubah menjadi struktur impulsif bullish—"berkat" Donald Trump. Gambaran wave ini sangat mirip dengan pasangan EUR/USD. Hingga 28 Februari, kami mengamati pembentukan struktur korektif

GBP/USD Analisis: Sejak awal tahun ini, GBP/USD telah membentuk gelombang naik pada grafik harian. Pasangan ini sekarang telah mencapai batas zona potensi pembalikan yang luas. Pada saat analisis, harga berada

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.