Voir aussi

28.09.2023 06:03 AM

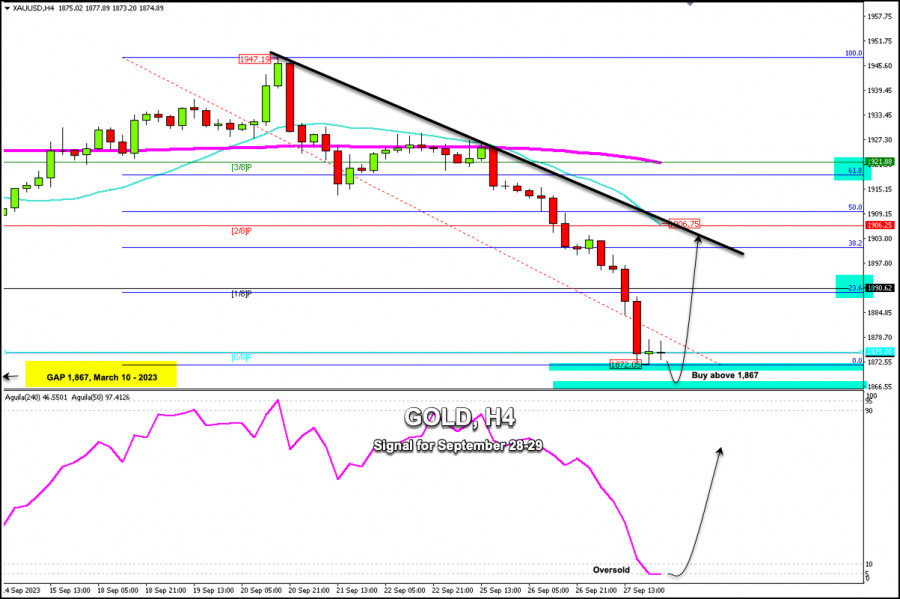

28.09.2023 06:03 AMEarly in the European session, Gold is trading around 1,874.75 around 0/8 Murray and bouncing slightly after it hit the low around 1,872.20, a level last seen in March 2023.

This sharp drop of almost $75.00 in the last 7 days from the high of 1,947 means the risk aversion of investors and the fears that surround it.

According to the H-4 chart, gold has reached extremely oversold levels. The metal is expected to see a technical rebound in the coming days and the price could reach 2/8 Murray located at 1,906.

Gold accelerated its fall after breaking the psychological level of 1,900 due to the pressure of the US dollar index and the rise in the yields of the 10-year Treasury bonds that reached a high of 4.65%. This generated risk aversion and investors left gold as a refuge asset and supported the dollar.

There is a possibility that the price of gold will fall to the level of 1,867 because gold left a Gap on March 10, 2023, that still needs to be covered. This level could be the key for a strong technical rebound and from that point, a recovery of the yellow metal could occur.

On the other hand, there is a possibility that gold will rebound from the current levels above 1,872 because that area is located at 0/8 Murray which acts as strong support. This level could offer an opportunity to buy with targets at 1,885 and at 1,906. The eagle indicator is showing signs of an imminent technical rebound due to oversold conditions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.