See also

15.04.2025 06:40 PM

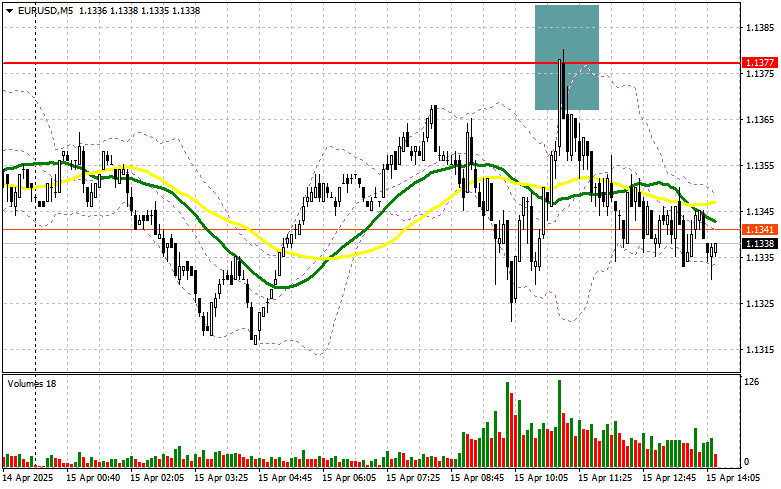

15.04.2025 06:40 PMIn my morning forecast, I highlighted the 1.1377 level and planned to make trading decisions from there. Let's look at the 5-minute chart and break down what happened. A rise followed by a false breakout near 1.1377 provided a good entry point for selling the euro, which led to a 40-point drop in the pair. The technical picture was not revised for the second half of the day.

To open long positions on EUR/USD:

Weak IFO data from Germany and the Eurozone disappointed traders and prevented EUR/USD from continuing its growth. However, no large-scale sell-off occurred either, indicating a presence of buyers — only time is needed for a new upward wave. In the second half of the day, we await U.S. data on the Empire State Manufacturing Index and Import Price Index. Only very strong figures are likely to trigger demand for the dollar.

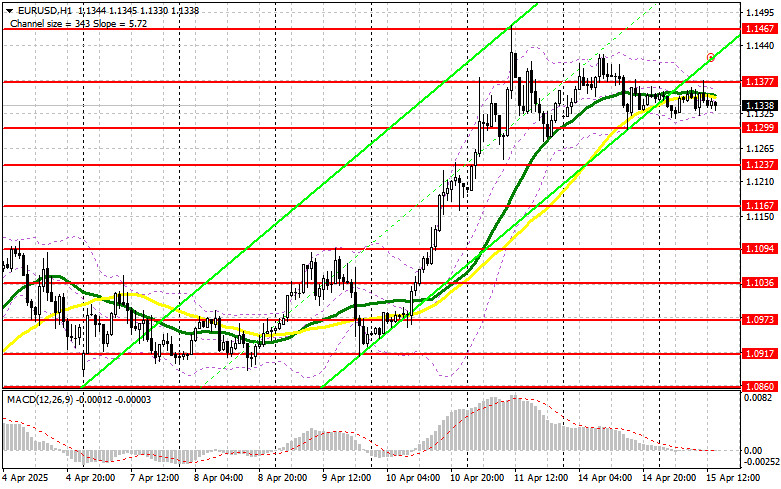

I will act similarly to the first half of the day. In the event of good U.S. data (which is unlikely), pressure on the euro will return. However, only a false breakout around the 1.1299 support will be a signal to buy EUR/USD, targeting a continuation of the bullish trend and a retest of 1.1377 — a level that couldn't be broken in the morning session. A breakout and retest from above would confirm a new long entry, with a potential move to 1.1467 — the yearly high. The final target is 1.1562, where I plan to take profit.

If EUR/USD falls and there is no bullish activity around 1.1299, pressure on the euro will increase. In this case, bears may push the pair down to 1.1237. Only after forming a false breakout there will I consider long positions. I will also look to buy from a rebound at 1.1167, targeting a 30–35 point intraday correction.

To open short positions on EUR/USD:

If U.S. data disappoints and no statements are expected from Fed officials today, then a false breakout near 1.1377 — as described above — will be enough to re-enter short positions, aiming for a decline toward the 1.1299 support. A breakout and consolidation below this area would open the way to 1.1237. The final target is 1.1167, where I plan to take profit.

If EUR/USD rises again in the second half of the day and bears remain inactive around 1.1377 — where moving averages are also clustered — bulls could drive the pair back to last week's highs. In this case, I will postpone selling until a test of the next resistance at 1.1467 and only enter short after a failed consolidation. If there's no pullback even there, I'll look for short entries from 1.1562 based on a 30–35 point intraday correction.

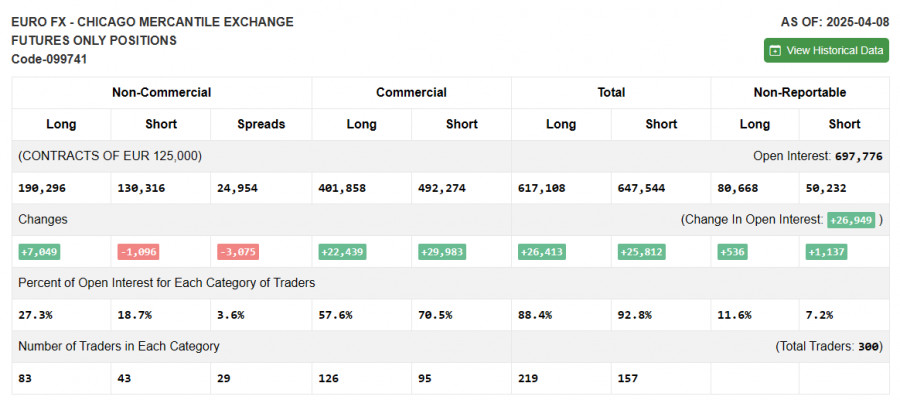

The COT report (Commitments of Traders) for April 8 showed an increase in long positions and a decrease in short ones. Given Trump's 90-day tariff freeze, the euro resumed its upward trend, as reflected by the growth in long positions. Additionally, fundamental data on declining inflation in the Eurozone boosted euro demand, as markets anticipate more aggressive action from the ECB to support the economy.

According to the COT report, long non-commercial positions increased by 7,049 to 190,296 and short non-commercial positions decreased by 1,096 to 130,316. As a result, the net long position widened by 2,466.

Indicator Signals

Moving Averages Trading is occurring near the 30- and 50-period moving averages, indicating a sideways market.

Note: The author refers to H1 chart moving averages, which differ from the traditional daily MAs on the D1 chart.

Bollinger Bands The lower band around 1.1324 will act as support in case of a decline.

Indicator Descriptions:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the 1.1485 level as a key decision point for market entry. Let's look at the 5-minute chart and examine what happened. The pair dipped

Analysis of Monday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade with substantial gains throughout Monday. On the first trading day of the week, there were

Analysis of Monday's Trades 1H Chart of EUR/USD The EUR/USD currency pair started Monday with a sharp rally. Overnight, the euro appreciated by 100–120 pips, and the pair traded more

The GBP/USD currency pair continued its upward movement on Monday as it did last week. The only difference was the strength of the movement. On Monday, volatility was very high—without

Analysis of Friday's Trades 1H Chart of GBP/USD On Friday, the GBP/USD pair showed extremely low volatility, yet the British pound steadily crept upward even with such market conditions

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed no movement on Friday. It was Good Friday, and Easter Sunday followed. As a result, many countries

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.