See also

Following Trump's speech at the crypto summit yesterday, pressure on Bitcoin and Ethereum has returned. Another factor contributing to this was a renewed sell-off in risk assets on the U.S. stock market. Recently, the crypto market has been closely correlated with equities, signaling an even greater dependence on developments in the U.S. economy.

Market participants did not receive the level of support from Trump's comments that had been widely anticipated, triggering a wave of selling, further amplified by broad market nervousness. Retail traders, fearing a deeper decline in the cryptocurrency market, continued to offload risk assets.

The correlation between the crypto market and the U.S. stock market points to the growing integration of digital assets into the traditional financial system. However, this also makes cryptocurrencies more vulnerable to macroeconomic factors and political rhetoric, which undoubtedly increases uncertainty for investors.

On the positive side, demand for Bitcoin is currently at levels last seen after the FTX collapse, when the market hit bottom. This indicates that institutional investors still have confidence in the space and are willing to return, despite the ongoing volatility. More and more, institutional players view Bitcoin as an alternative asset capable of hedging risks associated with traditional markets. Geopolitical instability and inflationary pressures in various countries are also pushing people to seek new, reliable capital preservation tools, and the growing infrastructure around Bitcoin is making this easier and more accessible.

Even though technical headwinds remain in the short term, the overall bullish trend for Bitcoin is intact. The recent price dynamics indicate further upside potential and support its position as the leading cryptocurrency.

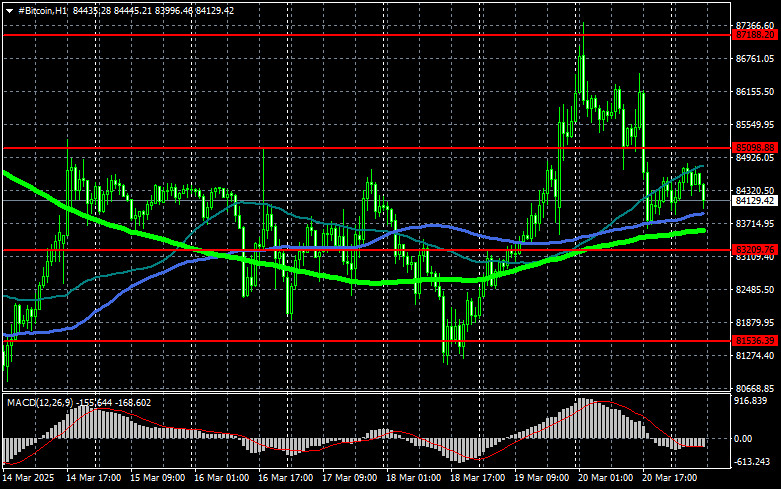

As for the technical picture for Bitcoin, buyers are currently aiming to reclaim the $85,000 level, which would open the way to $87,100, with $89,400 just beyond that. The final target is the high near $91,900—a breakout above this level would mark a return to a medium-term bull market. In the event of a decline, support is expected at $83,200. A drop below that could quickly send BTC toward $81,500, with the final bearish target near $79,700.

For Ethereum, a solid hold above $1,989 opens the way to $2,027. The final target is the yearly high near $2,082—a breakout above this would also signal a return to a medium-term bull market. If Ethereum falls, buyers are expected near $1,954. A return below this level could send ETH toward $1,917, with a final bearish target near $1,871.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.