See also

07.03.2025 02:55 PM

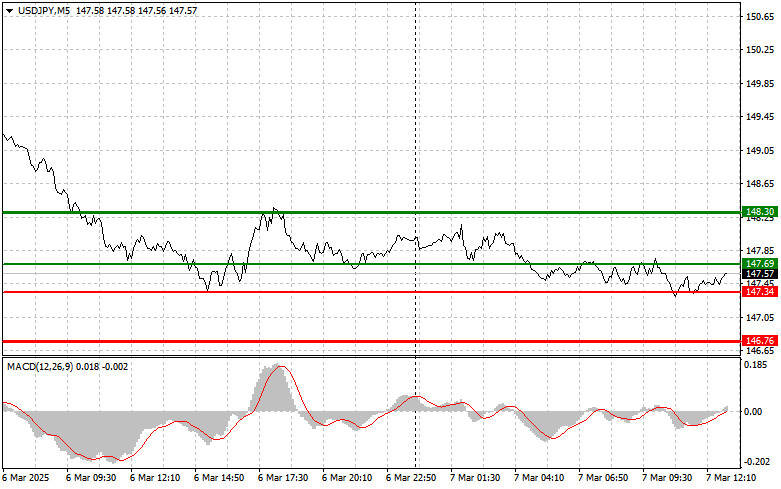

07.03.2025 02:55 PMThe test of 147.41 occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I refrained from selling the U.S. dollar.

Today's disappointing Nonfarm Payrolls and Unemployment Rate reports from the U.S. could negatively impact the dollar's position. Market participants are concerned that weak economic data may push the Federal Reserve toward a more cautious monetary policy stance. If job growth exceeds expectations, the dollar may strengthen, though its upward potential in the USD/JPY pair is likely to remain limited due to diverging central bank policies. Conversely, a higher unemployment rate would signal potential economic difficulties in the U.S., further weakening the dollar.

For intraday trading, I will focus on Scenario #1 and Scenario #2.

The first buying opportunity for USD/JPY today is near 147.69, targeting a rise to 148.30. Around this level, I plan to exit long positions and open short trades, expecting a 30-35 point downward correction. A bullish correction could support this move. Before buying, it is essential to confirm that the MACD indicator is above the zero mark and just beginning to rise.

Another buy opportunity arises if 147.34 is tested twice while the MACD is in oversold territory. This scenario would indicate limited downward potential and a possible reversal upward. The expected targets in this case would be 147.69 and 148.30.

A short position can be initiated if the price breaks below 147.34, likely triggering a decline toward 146.76. At this level, I plan to exit shorts and open long positions on a rebound, anticipating a 20-25 point correction. Bearish pressure on the pair could emerge at any moment. Before selling, it is crucial to confirm that the MACD is below the zero mark and just beginning to decline.

Another selling opportunity will be available if 147.69 is tested twice while the MACD is in overbought territory. This scenario would indicate limited upward potential and trigger a reversal downward. The expected downward targets would be 147.34 and 146.76.

Beginner traders should be extremely cautious when entering the market, especially before major economic releases. It is often best to stay out of the market during news events to avoid sudden price fluctuations. If trading during these periods, always use stop-loss orders to minimize losses. Trading without stop-loss protection can quickly deplete capital, especially for those using large position sizes.

To trade successfully, it is crucial to have a structured trading plan, such as the one outlined above. Making impulsive trading decisions based on short-term market conditions is an inherently losing strategy for intraday traders.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 142.20 occurred when the MACD indicator had already moved significantly below the zero line, limiting the pair's downside potential. For this reason, I didn't sell

The price test at 1.3268 occurred when the MACD indicator moved significantly above the zero line, limiting the pair's upside potential. For that reason, I did not buy the pound

The test of the 142.38 level coincided with a moment when the MACD indicator had already significantly moved below the zero mark, which limited the pair's downside potential. For this

The test of the 1.3249 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reason

The test of the 1.1357 price level occurred when the MACD indicator had already dropped significantly below the zero line, which limited the pair's downside potential. For this reason

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.