See also

21.02.2025 10:21 AM

21.02.2025 10:21 AMThe initial impact of D. Trump's presidency on financial markets has been mixed. Let's examine the key takeaways.

Starting with stock markets, the U.S. stock market has remained close to its previously reached historical highs. The broad market index S&P 500, after a month of Trump's presidency (he officially took office on January 20), was trading near its local high of 6,127.50 points. Although the industrial DOW 30 did not reach its peak of 45,000.00 points, it closed not far from it, as did the high-tech NASDAQ 100.

This raises a question: Why is the U.S. stock market still near its all-time highs, especially when the Federal Reserve is unlikely to cut rates further due to rising inflation?

Expectations of economic stimulus are likely driven by the protectionist policies of the new president, which promise significant opportunities for growth in domestic production and overall economic expansion.

What can we expect from the stock market?

At the very least, it is likely to consolidate at these historical levels for some time, and at most, it may continue to rise.

The cryptocurrency market has effectively stalled in its growth, a trend that has been evident across nearly all major crypto assets against the dollar in the lead-up to the U.S. presidential election results. This stagnation can be attributed to two main factors: first, there are increasing investment opportunities in the U.S. economy, particularly in stocks. Second, there is an expectation of a stronger dollar due to rising inflation and a lack of clear indicators regarding the widespread adoption of cryptocurrencies in the global economy. As a result, discussions on this topic remain largely speculative, which is limiting the demand for tokens.

What can we expect from the cryptocurrency market?

Until the situation becomes clearer, this segment of the global financial market is likely to move sideways.

Gold has been the biggest beneficiary of global geopolitical tensions, the temporary weakening of the U.S. dollar, and trade policy maneuvers under the Trump administration. Over the past four weeks, prices confidently surpassed the previous high of $2,790.10 per ounce, aiming for a new historical level of $3,000.00.

This level will likely be reached, fueled by the factors mentioned above. However, once the war in Europe ends, we should expect a deep correction in gold prices, as the worst of the geopolitical crisis will have passed. There is no doubt that this will eventually happen.

The U.S. dollar has been under pressure in the Forex market over the past four weeks despite a major supporting factor: the end of the Fed's rate-cutting cycle, with the potential for rate hikes, if U.S. inflation remains above 3% and continues rising.

In my opinion, the decline of the dollar on the ICE index can be attributed to a decreased demand for the USD as a safe-haven currency, along with uncertainty surrounding the actual implementation of Trump's economic program. However, I believe the dollar has the potential for renewed growth. This is due to the contrasting rate-cutting cycles of several Western central banks compared to the Fed's position, which currently sees no need for further monetary easing. If the current economic trends in the U.S. continue, I expect the ICE index to reach 114.00 points by mid-year.

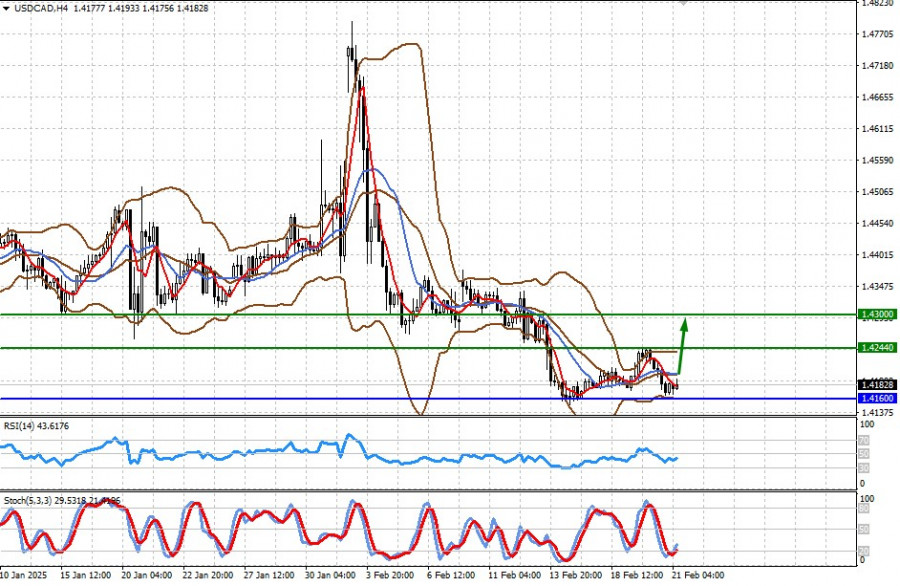

The pair is trading above the 1.4160 support level. There is a possibility that it will rise significantly next week, first reaching 1.4245, and then 1.4300.

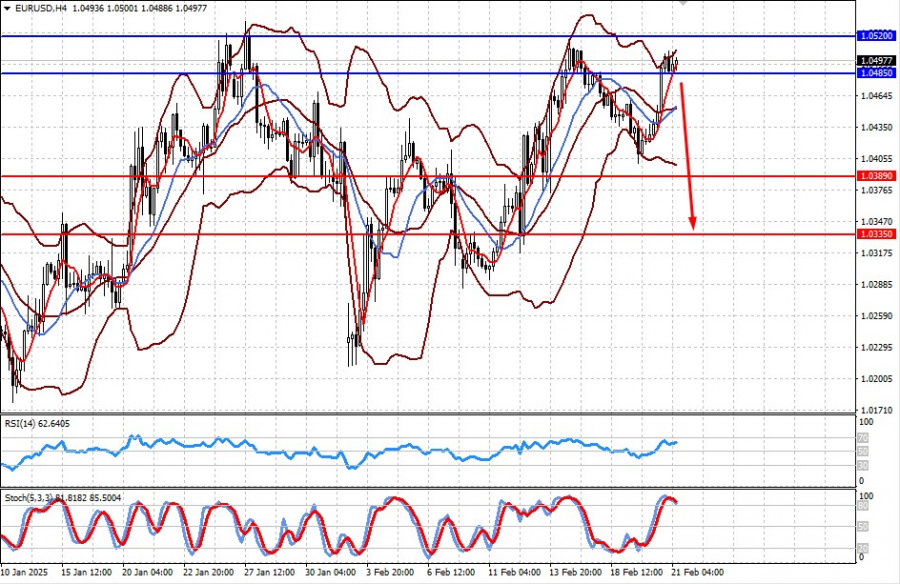

The pair is consolidating below 1.0520, around 1.0500. Its inability to break above 1.0520 could lead to a local reversal and a decline, first to 1.0390, and then to 1.0335 as early as next week.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topic

No macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simply

The GBP/USD currency pair also traded higher on Monday despite no clear reasons or fundamental grounds for this movement. However, the pound has risen even on days when the euro

The total speculative bearish position on the US dollar more than doubled over the reporting week, reaching -$10.1 billion. The Canadian dollar and the yen strengthened the most, while

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.