See also

1H Chart of GBP/USD

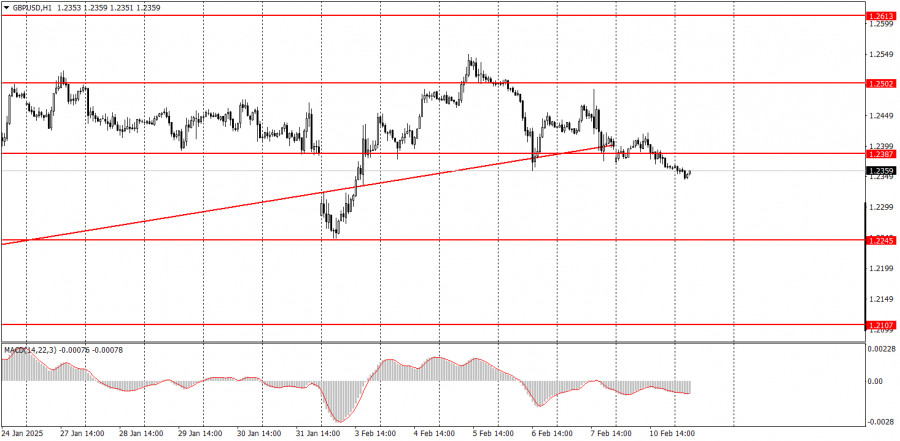

On Monday, the GBP/USD currency pair traded with low volatility and a slight downward inclination. The pair broke below the ascending trendline without much difficulty, suggesting the potential for a new short-term downtrend. However, several important events this week could support the British pound. Additionally, the current movement is still classified as corrective, which means the market could enter a choppy or sideways phase. No macro or fundamental events were recorded on Monday in either the U.S. or the U.K.

On the 5-minute timeframe, two trade signals were formed on Monday. The pair bounced off the 1.2372–1.2387 zone and moved up by about 25 points. However, it did not reach the nearest target, and the price quickly returned to its starting position, likely triggering a Stop Loss at breakeven. During the U.S. session, the pound remained within the 1.2372–1.2387 range and only broke out during the Asian session overnight. Therefore, short positions can be considered in the morning.

On the hourly timeframe, GBP/USD may enter a short-term downtrend, but the overall movement in recent weeks has been corrective on the daily timeframe. In the medium term, we fully support the pound's decline toward 1.1800, as we consider this the most logical scenario. Therefore, traders should wait for the daily timeframe correction to complete.

On Tuesday, the GBP/USD pair may continue its downward movement, as the price has broken below the ascending trendline.

On the 5-minute timeframe, key trading levels to watch are:1.2010, 1.2052, 1.2089–1.2107, 1.2164–1.2170, 1.2241–1.2270, 1.2301, 1.2372–1.2387, 1.2445, 1.2502–1.2508, 1.2547, 1.2633, 1.2680–1.2685, 1.2723, 1.2791–1.2798.

No major economic events are scheduled for Tuesday in the U.K., while in the U.S., Jerome Powell will deliver his first testimony before Congress. This is a highly significant event, as any Fed Chair speech can strongly influence market sentiment. The Fed remains the key driver of trading, rather than Donald Trump's policy moves.

Key Chart Elements:

Important Note for Beginner Traders:

Not every trade will be profitable. Developing a clear trading strategy and effective money management is essential for long-term success in Forex trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.