See also

27.01.2025 01:25 PM

27.01.2025 01:25 PMThe Japanese yen continues to gain support from the Bank of Japan's hawkish rate hike on Friday.

The currency market is witnessing an intriguing interaction between the Japanese yen and the U.S. dollar, particularly in light of recent developments. Despite short-term fluctuations within a specific range, the USD/JPY pair is finding support due to several factors.

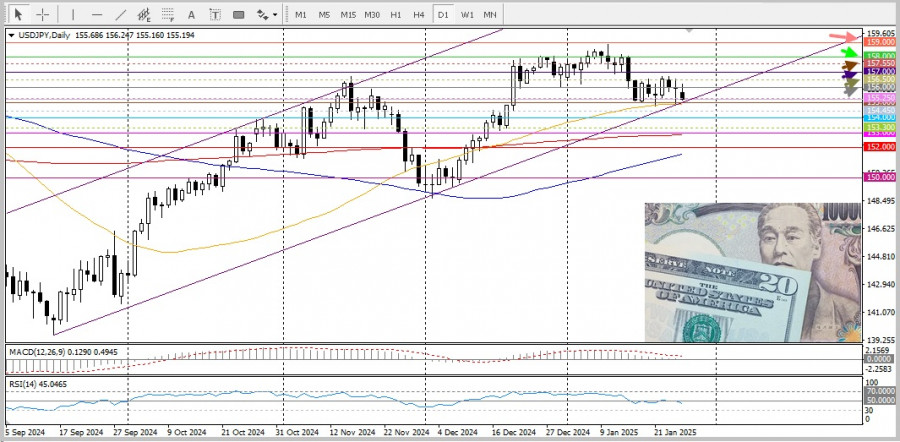

From a technical standpoint, the USD/JPY pair is finding support near the lower boundary of a multi-month ascending channel, currently situated around the 155.25 level. Below this level lies the psychological threshold of 155.00 and the support zone at 154.80–154.75, near the 50-day SMA. A decisive break below this support could serve as a new trigger for bearish momentum.

With the RSI (Relative Strength Index) on the daily chart just beginning to show negative momentum, the USD/JPY pair could accelerate its decline toward the 154.00 level, followed by 153.30 and eventually the next psychological level of 153.00.

This technical and fundamental backdrop suggests potential continued pressure on the pair, making it a focal point for traders monitoring yen strength and U.S. dollar weakness.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.