See also

23.01.2025 06:43 AM

23.01.2025 06:43 AMThe EUR/USD currency pair exhibited a restrained and calm trading pattern on Wednesday, as anticipated. Throughout the day, there were no significant movements, but the euro continued to rise steadily. We believe there are no solid grounds for the euro's appreciation. Consider this: on Monday, Tuesday, and Wednesday, neither the Eurozone nor the United States released any reports that would clearly justify the euro's growth. In fact, there were no noteworthy reports at all. So, what is driving the euro higher?

One could attribute this movement to common explanations such as "the Donald Trump factor" or "increased market risk appetite." However, what has truly changed since Trump's arrival? Before his inauguration, Trump frequently discussed tariffs, and he continues to do so afterward. Yet, no significant decisions with direct implications for the economy or geopolitics have been made, and they may never be. On American maps, he can rename the Gulf of Mexico as much as he likes or claim the Panama Canal as American property, but that does not affect the larger economic landscape.

We've mentioned this before, and we'll reiterate: promises are not the same as delivery. During his first term, Trump often operated under the principle of "the guy said it, then forgot it," sometimes within just 24 hours. Therefore, all his promises, threats, and bluffs should be taken with a grain of salt. We view Trump's imperialistic tendencies with a sense of calm, believing that he can only harm himself and the United States, which he has pledged to make "great again" numerous times.

As for the dollar, it rose for 3.5 consecutive months, as is evident on the daily timeframe. What we are witnessing now is a standard technical correction that does not require fundamental or macroeconomic reasons. The market is taking profits and accumulating new short positions on the EUR/USD pair. While it is possible that a new wave of euro declines may not occur anytime soon—or at all—there need to be solid reasons for the euro to establish a medium-term uptrend. Currently, there are no fundamental reasons to support this, unless the market suddenly views Trump's presidency as a significant risk and begins panic-selling the dollar. There are no macroeconomic reasons, nor are there technical ones.

Thus, we continue to expect only a decline in the euro, potentially even below parity with the dollar. Trump may attempt to pressure the Federal Reserve or take steps to weaken the dollar, but during his first four years, he failed to do either. This demonstrates that even the President of the United States cannot single-handedly "run the show."

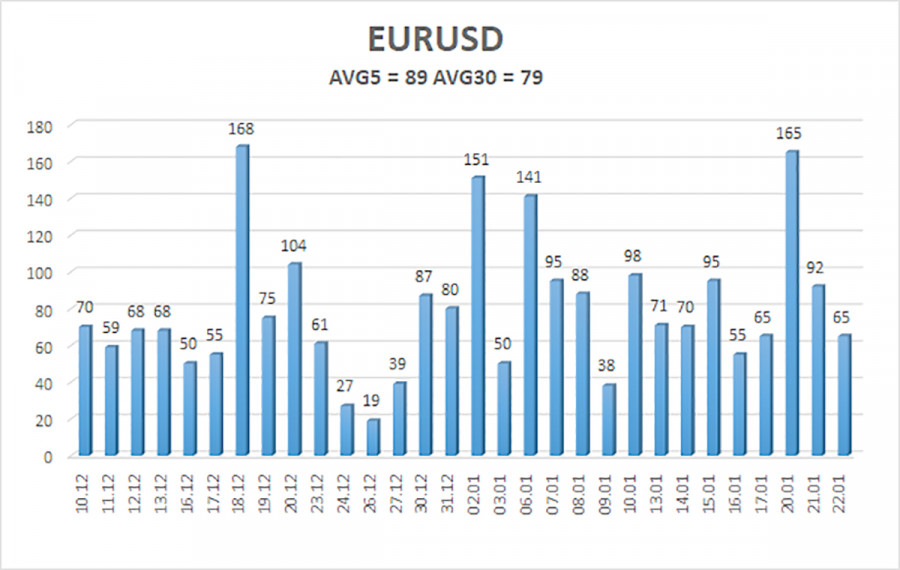

The average volatility of the EUR/USD currency pair over the past five trading days stands at 89 pips, classified as "high." On Thursday, we expect the pair to move between 1.0326 and 1.0504. The higher linear regression channel remains directed downward, indicating a continuation of the global downward trend. The CCI indicator has entered the overbought area, which now signals a potential resumption of the downward trend. A bearish divergence may also form, which could trigger the next phase of decline.

Nearest Support Levels:

Nearest Resistance Levels:

The EUR/USD pair has entered a new corrective phase. In recent months, we have consistently indicated our expectation of a medium-term decline in the euro. Consequently, we fully support the overall downward trend and believe it is not yet complete. The Fed has paused its monetary policy easing, while the European Central Bank is accelerating its efforts in this regard. As a result, there are no fundamental reasons for a medium-term decline of the dollar, aside from purely technical and corrective factors.

Short positions remain relevant, with targets at 1.0254 and 1.0193; however, the current correction needs to conclude first. This correction may end near the 1.0437 level. If you are trading based on purely technical analysis, long positions can be considered if the price consolidates above the moving average, with targets at 1.0437 and 1.0498. It is important to note that any growth at this stage is currently classified as a correction.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The GBP/USD currency pair also traded higher on Friday. However, it's worth noting that the British currency—once praised for its remarkable resilience against the dollar in recent years—is now rising

On Thursday, investors realized there is currently no such thing as stability. High market volatility remains and will continue to dominate for some time. The ongoing cause of this remains

A relatively large number of macroeconomic events are scheduled for Friday, but none are expected to impact the market. Of course, we may see short-term reactions to individual reports

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.