See also

06.11.2023 09:30 PM

06.11.2023 09:30 PMFirst outlook :

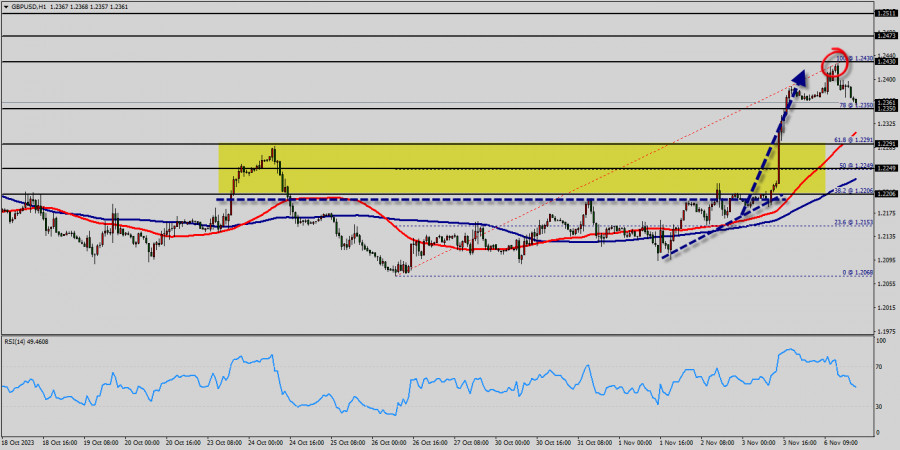

The GBP/USD pair broke resistance which turned to strong support at the level of 1.2107 this week. The level of 1.2107 is expected to act as major support today. From this point, we expect the GBP/USD pair to continue moving in a bullish trend from the support levels of 1.2107 and 1.2140.

Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Consequently, the first support is set at the level of 1.2107 (horizontal black line). So, the market is likely to show signs of a bullish trend around the spot of 1.2107.

In other words, buy orders are recommended above the spot of 1.2107 with the first target at the level of 1.2186; and continue towards 1.2270 (the weekly resistance 2). This would suggest a bearish market because the moving average (100) is still in a positive area and does not show any trend-reversal signs at the moment.

On the other hand, if the GBP/USD pair fails to break through the resistance level of 1.2186 this week, the market will decline further to 1.2107. The pair is expected to drop lower towards at least 1.2147 with a view to test the weekly pivot point. Also, it should be noted that the weekly pivot point will act as minor support today. Also, the level of 1.2147 represents a weekly pivot point for that it is acting as major resistance/support this week. However, if a breakout happens at the resistance level of 1.2336, then this scenario may be invalidated.

Second outlook :

The GBP/USD pair broke resistance which turned to strong support at the level of 1.2186 yesterday. The level of 1.2186 coincides with a golden ratio (50% of Fibonacci), which is expected to act as major support today.

The Relative Strength Index (RSI) is considered overbought because it is above 40. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend.

In other words, buy orders are recommended above 1.2277 with the first target at the level of 1.2336. From this point, the pair is likely to begin an ascending movement to the point of 1.2336 and further to the level of 1.2386. Consequently, the first support is set at the level of 1.2186. So, the market is likely to show signs of a bullish trend around the spot of 1.2186.

If the GBP/USD pair succeed to break through the resistance level of 1.2270, the market will scaling further to 1.2336. This would suggest a bullish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.2386 with a view to test the daily resistace 2.

The level of 1.2386 will act as strong resistance and the double top is already set at the point of 1.2336. On the other hand, if a breakout happens at the support level of 1.2186, then this scenario may become invalidated.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

If we look at the 4-hour chart of the GBP/CHF cross currency pair, there are several interesting facts. First, the appearance of a Triangle pattern followed by the movement

With the price movement of the AUD/CAD cross currency pair moving above the WMA (21) which has an upward slopes and the appearance of Convergence between the price movement

The eagle indicator has reached overbought levels. However, the metal could still reach the high around 8/8 Murray, which represents a strong barrier for gold. Below this area, we could

From what is seen on the 4-hour chart, the EUR/GBP cross currency pair appears to be moving above the EMA (100), which indicates that Buyers dominate the currency pair

With the appearance of Convergence between the price movement of the main currency pair USD/JPY with the Stochastic Oscillator indicator and the position of the EMA (100) which is above

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.