See also

27.05.2022 10:48 AM

27.05.2022 10:48 AMWeak GDP data may convince Fed to adjust its policy

Yesterday, the British pound followed the trajectory of the euro and strengthened against the US dollar. On Thursday, the report on US GDP for the first quarter showed negative dynamics. The world's leading economy contracted by more than expected: - 1.5% instead of an estimated -1.3%. As I have already mentioned in my review on the euro/dollar pair, the US Federal Reserve may ease its monetary tightening against this backdrop. If the economy shows signs of weakness, a hawkish approach could send it into recession. It is too early to draw such a conclusion. Judging by the FOMC minutes released this Wednesday, the regulator sees the state of the economy and the labor market as rather strong. However, everything can change.

In his speech on Thursday, UK finance minister Rishi Sunak voiced concern about high inflation, saying that the regulator has tools to keep it in control. However, not many options are left apart from tightening monetary policy by the Bank of England, which means further rate hikes. Mr. Sunak noted that the UK central bank has its own vision of monetary policy. In the coming months, members of the committee will offer more favorable conditions for attracting investment and supporting business. In general, the speech of the Chancellor of the Exchequer was quite optimistic, which was probably the factor driving the pound higher. Today, traders need to pay attention to the macroeconomic data from the US. More details are available in the Economic Calendar.

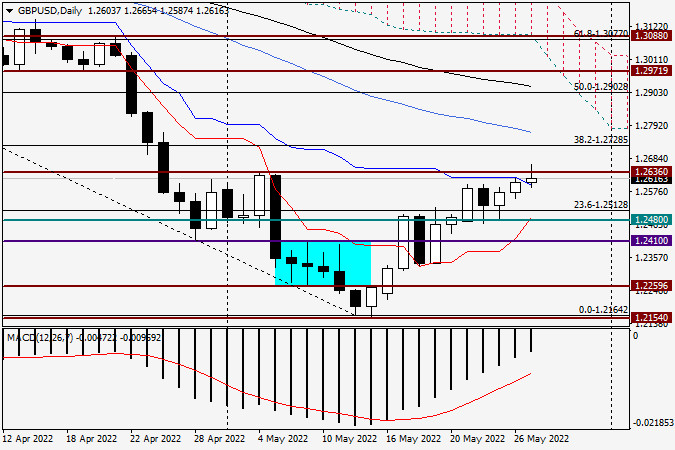

Daily chart

From the technical point of view, the GBP/USD chart remained mostly unchanged despite yesterday's growth. Yet, the sterling closed the session on Thursday above the key level of 1.2600. At the moment of writing, the pair is testing a strong resistance level located at 1.2636. Today, GBP/USD is already trading above the blue Kijun line of the Ichimoku Indicator, which also confirms the bullish trend. Although the price has already reached the daily high of 1.2665, bulls failed to settle above the resistance at 1.2636. However, they still have plenty of time to do this. It is quite possible that the macroeconomic data from the US will influence the results of the weekly session. In my opinion, the upside movement of the pair looks very likely but I wouldn't advise you to go long on a breakout of a strong resistance level, especially at the end of the week. I recommend taking a break until Monday when we analyze a full picture based on the weekly chart.

Have a good weekend!

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

If we look at the 4-hour chart of the GBP/CHF cross currency pair, there are several interesting facts. First, the appearance of a Triangle pattern followed by the movement

With the price movement of the AUD/CAD cross currency pair moving above the WMA (21) which has an upward slopes and the appearance of Convergence between the price movement

The eagle indicator has reached overbought levels. However, the metal could still reach the high around 8/8 Murray, which represents a strong barrier for gold. Below this area, we could

From what is seen on the 4-hour chart, the EUR/GBP cross currency pair appears to be moving above the EMA (100), which indicates that Buyers dominate the currency pair

With the appearance of Convergence between the price movement of the main currency pair USD/JPY with the Stochastic Oscillator indicator and the position of the EMA (100) which is above

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.