“头肩”模式主要是一种逆转模式。 这种模式是在3个顶部或3个底部的基础上形成的,而且中间顶部(底部)比另外两个高。

作为一项规则,新手交易者正在试图在交易图表上找到流行的头肩模式。 几乎所有关于货币交易的书籍都有这种模型的描述,专家会撰写关于它的研究论文,阅读讲座等。然而,尽管这种模式非常受欢迎,但大多数交易者认为它是完全错误的,并且不知道如何在交易应用它。

头肩是趋势逆转模式。 换句话说,如果你看到这种模式,那么在它最终形成之后,一般来说,主要趋势会部分或完全逆转。 这意味着头部和肩部的图案形成在高点或低点。

这种模式是在3个峰值或3个谷值的基础上形成的。

逆转头肩形态由3个峰组成,其中中间峰高于另外两个峰。 中间峰值(头部)的正确最小值位于比峰值的左边最小值稍高的位置。 换句话说,头肩模式的颈线左侧应稍高一些。 尽管这种情况对于这种模式来说很理想,但有些情况下,颈线是水平的,有时甚至稍微向左侧倾斜。 这些模型也可以工作,但失败的可能性明显高于标准的头肩模式。

让我们分析什么时候是以头肩模型为理由进入和退出市场的最佳时机。 通常情况下,突破颈线是一个明显的迹象。 换句话说,烛台收于颈线下的是卖出的信号。

我们的最低赢利目标与从中高峰(头部)到颈线的距离成正比。 但是,这种逆转模式通常可以产生比给定距离更大的利润。 因此,在达到设定的止盈水平时,最好的选择是结束部分交易,并将交易的其余部分设置为追踪止损或计算新的目标,例如使用斐波纳契回撤。

卖出交易,止损必须至少设置在右肩之上。 另外,交易量在头肩模式中非常重要。

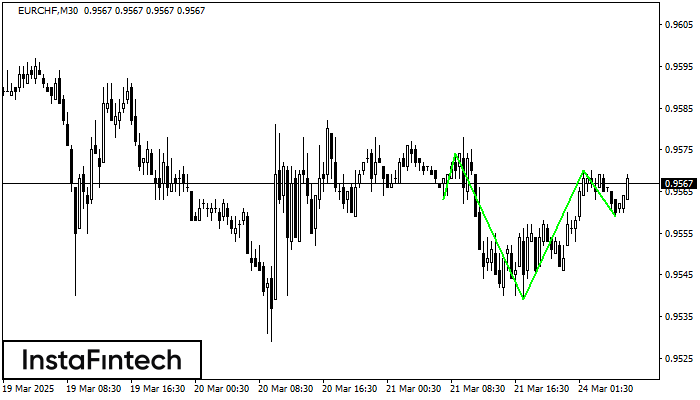

According to the chart of M30, EURCHF produced the pattern termed the Inverse Head and Shoulder. The Head is fixed at 0.9539 while the median line of the Neck

Open chart in a new window

According to M30, AUDCHF is shaping the technical pattern – the Inverse Head and Shoulder. In case the Neckline 0.5584/0.5578 is broken out, the instrument is likely to move toward

Open chart in a new window

According to the chart of M30, AUDJPY formed the Head and Shoulders pattern. The Head’s top is set at 95.69 while the median line of the Neck is found

Open chart in a new windowInstaForex俱乐部

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.