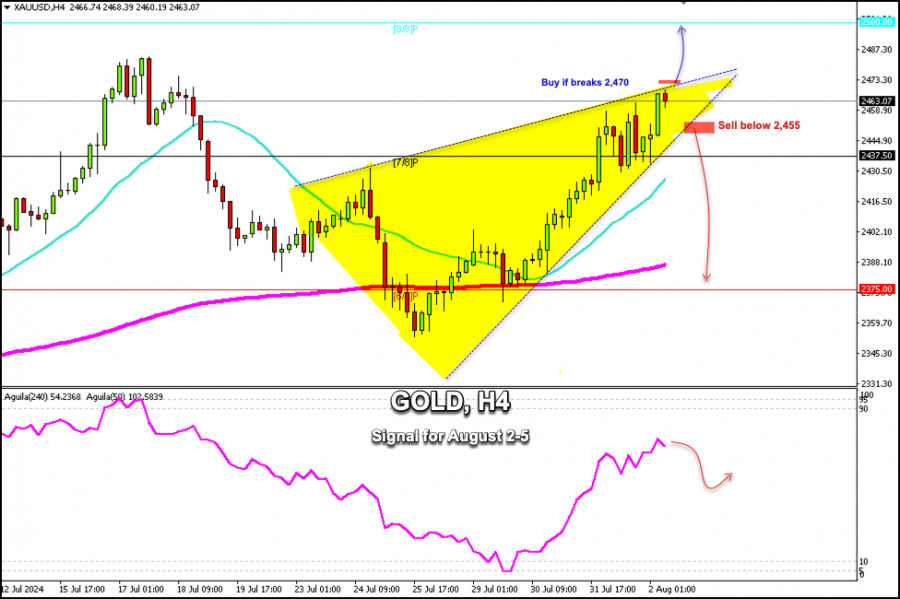

在美國交易時段早期,黃金交易價格維持在2,463美元,處於對稱三角形的形態內,展示出積極信號,但已經達到超買水平,這可能導致技術性回調。隨後,黃金可能會恢復其上漲周期。

美國非農就業人數數據將在幾小時後公佈,因此市場將會受到強烈的波動影響。

我們相信,如果美國數據顯示就業強勁,我們可以預期黃金將經歷顯著的技術性回調,價格可能下降至2,437美元,甚至加速其下跌周期,達到6/8 Murray的2,375美元水平。

另一方面,如果美國數據反映就業疲弱,我們可以期待黃金繼續其上漲周期,但需要突破並鞏固在2,470美元以上。

如果出現這種情況,黃金可能會達到7月17日的高點2,483.48美元,最終達到8/8 Murray的心理水平2,500美元。

我們觀察到黃金的上升動力有所疲弱。只有當突破上升趨勢通道且鞏固在2,455美元以下時,黃金才可能進行技術性回調。

因此,我們應該關注這一點,因為在該區域以下,我們可能會看到黃金下跌至21 SMA所在的2,422美元,最終跌至200 EMA所在的2,385美元。這可以被視為一個賣出機會。

You have already liked this post today

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

InstaForex

PAMM账户

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.