NZDMXN (New Zealand Dollar vs Mexican Peso). Exchange rate and online charts.

Currency converter

27 Mar 2025 04:35

(-0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

NZD/MXN (New Zealand Dollar vs Mexican Peso).

NZD/MXN is not a very popular currency pair on Forex market. Being the cross rate against the U.S. dollar, the pair is greatly affected by it. In such a way, by merging the NZD/USD and USD/MXN price charts, it is possible to get an approximate NZD/MXN price chart.

As the U.S. dollar has a great impact on both currencies, it is necessary to monitor the U.S. economic indicators such as the discount rate, GDP growth, unemployment rate, new vacancies and many others to analyze the pair. However, the discussed currencies can respond with different speed to the changes in the U.S. economy.

Besides, when trading NZD/MXN, it is necessary take into account such indicators of the New Zealand economy as GDP growth, discount rate, economic activity, level of trade with other countries, etc. New Zealand is one the largest wool producers in the world. This industry contributes a lot to the country's economy. It should be noted that New Zealand's economy is highly dependent on its main trading partners - the USA, Australia, and the Asia-Pacific region. For this reason, you should also take into account a variety of economic indicators of the main business partners of New Zealand.

Mexico takes the first position among Latin American countries in terms of per capita income. It is the most developed country in Latin America. Mexican economy is mainly represented by the private sector: in 1980s there was a mass privatization program which was implemented with the purpose to overcome the economic crisis. Now the majority of enterprises are owned by foreign companies.

Mexico is a NAFTA (the North American Free Trade Agreement) member. Country's active trading with the USA and Canada yields a major part of the government revenue.

Mexico is the largest oil exporter in its region. This sector makes up the greater part of country's export receipts. However, the main source of income for Mexico is its service sector.

Although Mexico has huge oil and gas reserves, its natural hydrocarbon reserves are strongly depleted. Thus, the government has to reduce oil and natural gas output to avoid new problems in the economy. According to the forecasts, Mexico will soon be forced to import oil from abroad to meet the needs of its economy. Such circumstances have a significant impact on the Mexican national currency which depends on global oil prices. In addition, the Mexican peso exchange rate is affected by the international rating of the country which is calculated by international rating agencies.

NZD/MXN has low liquidity as compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you analyze this financial instrument, you should primarily focus on NZD/USD and USD/MXN pairs.

As a rule, brokers set a higher spread for cross rates than for major currency pairs. Therefore, read carefully the terms and conditions offered by the broker before trading crosses.

See Also

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1618

Gold maintains a positive tone today, but lacks strong bullish momentumAuthor: Irina Yanina

11:54 2025-03-26 UTC+2

1588

Bulls pushed for two weeks, but now it's time for a pauseAuthor: Samir Klishi

11:32 2025-03-26 UTC+2

1423

- The GBP/USD rate declined by 55 basis points on Wednesday, marking the largest drop of the current week.

Author: Chin Zhao

18:37 2025-03-26 UTC+2

1288

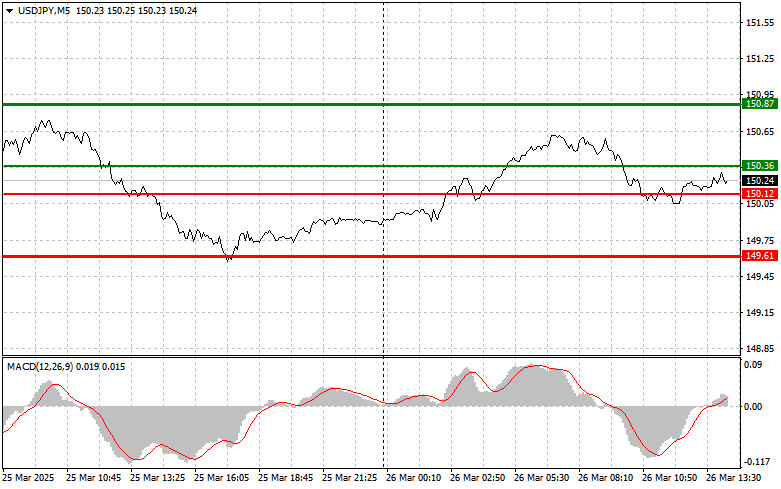

USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:35 2025-03-26 UTC+2

1243

GBP/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:29 2025-03-26 UTC+2

1243

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1198

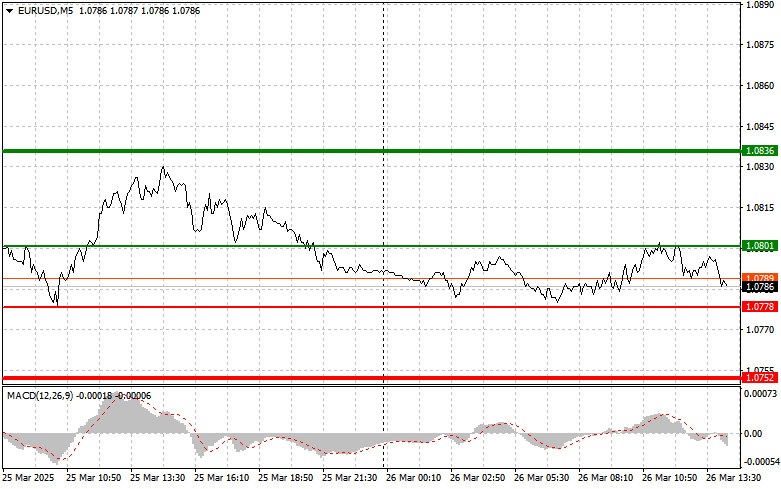

EUR/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)Author: Jakub Novak

18:27 2025-03-26 UTC+2

1168

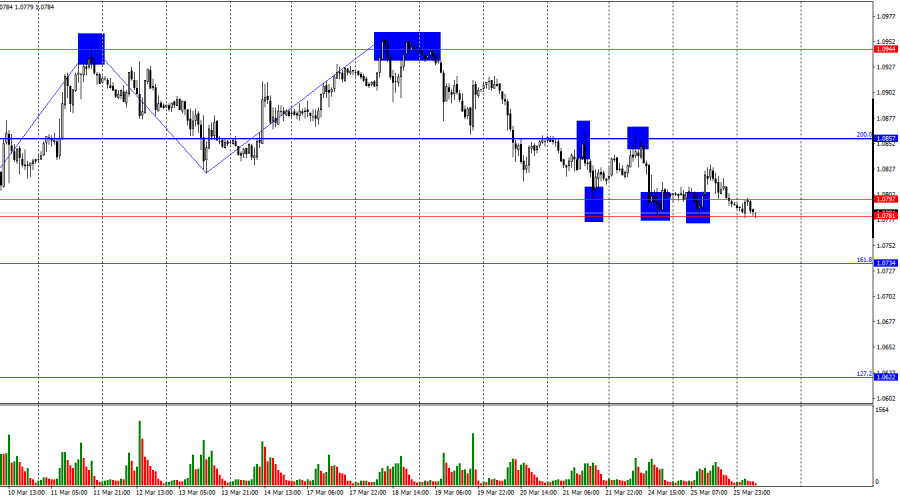

Technical analysisTrading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Author: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1138

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1618

- Gold maintains a positive tone today, but lacks strong bullish momentum

Author: Irina Yanina

11:54 2025-03-26 UTC+2

1588

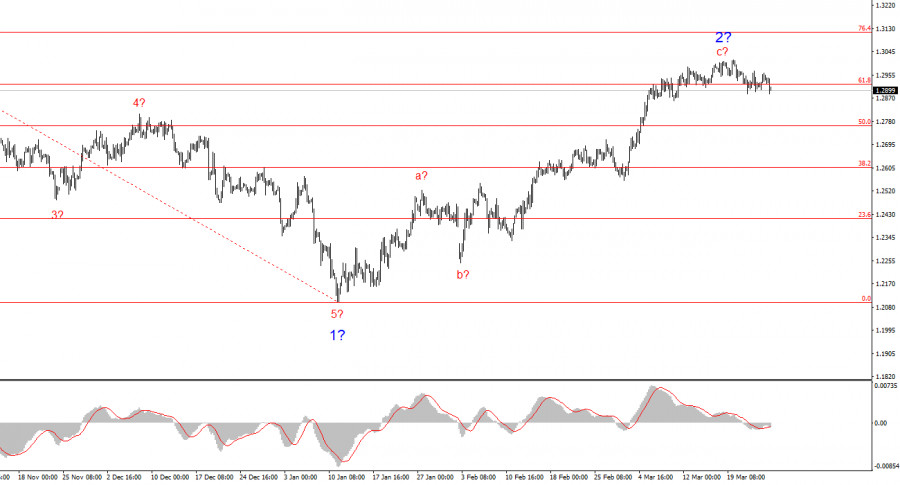

- Bulls pushed for two weeks, but now it's time for a pause

Author: Samir Klishi

11:32 2025-03-26 UTC+2

1423

- The GBP/USD rate declined by 55 basis points on Wednesday, marking the largest drop of the current week.

Author: Chin Zhao

18:37 2025-03-26 UTC+2

1288

- USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:35 2025-03-26 UTC+2

1243

- GBP/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:29 2025-03-26 UTC+2

1243

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1198

- EUR/USD: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:27 2025-03-26 UTC+2

1168

- Technical analysis

Trading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Author: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1138