21.12.2022 05:11 PM

21.12.2022 05:11 PMThere are only a few days left before the New Year and the Catholic Christmas, both of which cause the market to freeze in pre-holiday bliss. There is also just over a week and a half until the New Year. Many pairs in the major group exhibit low volatility and respond instinctively to the information flow at hand. The impulses from the north and south almost immediately stopped. Dollar pairs are anticipating this Friday's publication of the crucial report for the current week. Since this report has the potential to increase volatility, traders are not in a rush to start trading before it is released.

The dollar/yen pair, however, stands out in this instance. The Japanese yen emerged as the major December phenomenon. Is it a joke? Yesterday, in response to the outcomes of the Bank of Japan's December meeting, the USD/JPY pair fell by 700 points in a single day. Buyers were able to retake some (a small portion) of the lost positions at the end of the trading day, but the pair remains bearish.

We can assume that we are dealing with a long-lasting southern trend because it started at the end of October when the Japanese government carried out its second currency intervention, not yesterday. Later, when the USD/JPY bears' representatives abruptly started to speak in hawkish tones, the Japanese regulator stepped in to support them. The Bank of Japan meeting in December struck the final chord, leading to an expansion in the regulator's tolerance for variations in the target yield on ten-year bonds. The acceptable range has changed from plus or minus 0.25 percent to plus or minus 0.5 percent. The central bank made a brief statement regarding its choice, claiming that the prior range "could have harmed market operations."

The fact that the yield curve's control structure had changed did not cause the yen to react as violently. Generally speaking, this is a relatively minor change to the DCP, especially given that the Bank of Japan has kept the remaining monetary policy variables unchanged. The market interpreted the Japanese regulator's decision as a sign that, after many years of inaction, it is ready for change. This is sort of a trial balloon, and there will probably be more to come. Given that the current Bank of Japan president, Haruhiko Kuroda, will step down from his position in four months when his second (and final) term ends in April, such assumptions seem to be quite reasonable.

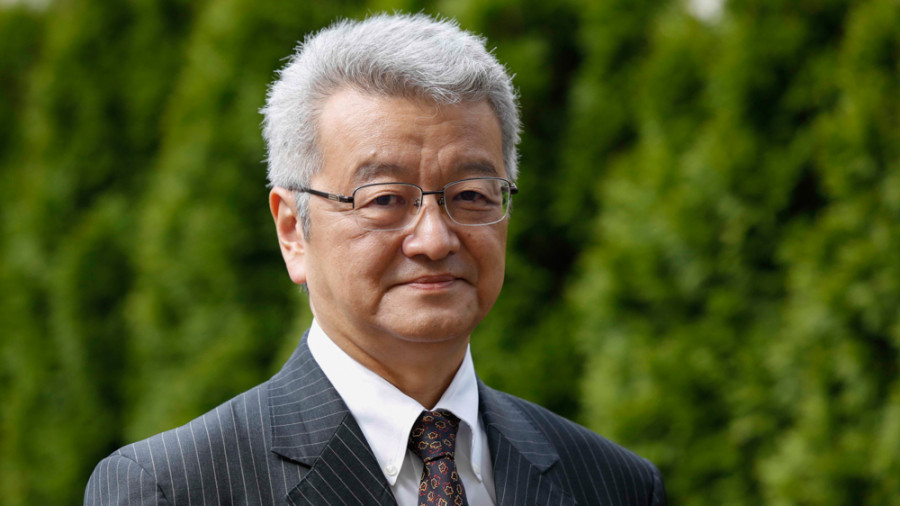

In light of yesterday's events, the market started actively discussing potential candidates for the position that will soon become vacant. The name Takatoshi Ito (Professor at the National University's Higher School of Political Sciences) frequently appears in this context. Ito commented yesterday regarding the Bank of Japan's controversial decision. He asserts that the shift in the Central Bank's approach to managing the yield curve "may be the first step towards exiting the ultra-soft monetary policy regime."

Such a hawkish message from Kuroda's possible successor exerted significant pressure on the USD/JPY pair.

Additionally, the market has already started to debate potential exit strategies from the regime of loose monetary policy. Additionally, the mere fact of these conversations adds to the pair's stress. For instance, experts at Goldman Sachs believe that the Bank of Japan's next move could be to completely relinquish control over the yield curve. It is also possible to find more radical solutions, such as ending the practice of negative interest rates. According to Goldman Sachs strategists, the likelihood of such an event is gradually increasing. It is also noted that the Bank of Japan is not likely to widen the target range any further. But with a new "boss" in charge, the next move is probably going to be more radical.

Such expert predictions, insider information, rumors, and analyst comments will strengthen the yen while simultaneously exerting pressure on the USD/JPY pair. The contradictory outcomes of the Fed meeting give the bears of the pair more room to move lower by, so to speak, "monetizing" market hawkish expectations for the Bank of Japan's future actions. Whether these expectations are realized or not is the second question that will only become relevant next year. The unexpected Central Bank decision, which the market categorically interpreted in favor of the Japanese currency, has allowed the yen to date to demonstrate its character.

Therefore, it is advised to open short positions during any corrective pullbacks on the USD/JPY pair.

The importance of the southern scenario is also expressed through technology. The pair is either on the lower or halfway line between the middle and lower lines of the Bollinger Bands indicator on all "older" timeframes (H4 and above). The Ichimoku indicator has also formed one of its strongest bearish signals, known as the "Line Parade," on the D1 timeframe. The mark of 130.50, which is the lower line of the Bollinger Bands on the weekly chart, is the closest and, as of now, the main objective of the southern movement.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

كان التفاؤل في الأسواق، الذي غذته تلاعبات دونالد ترامب النشطة في سردية التعريفات الجمركية، قصير الأمد. لا يزال المتداولون يركزون على تصاعد التوترات بين الولايات المتحدة والصين بعد قرار وزارة

إنستافوركس في الأرقام

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.